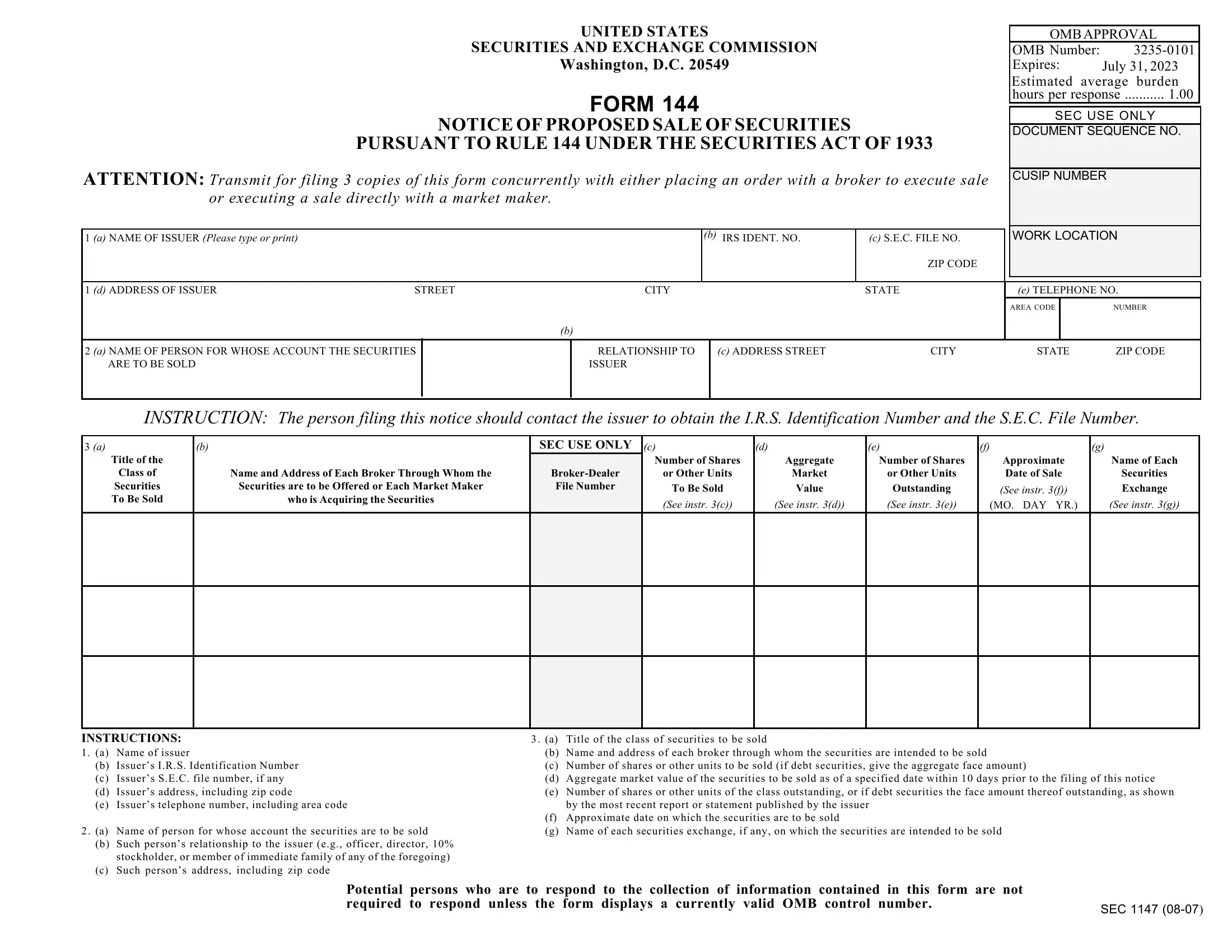

Understanding SEC Form 144 and Insider Selling Intentions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on my research, I can provide a comprehensive analysis of what Form 144 filings reveal about insider selling intentions and their implications for investor sentiment.

The filing explicitly announces an insider’s intention to sell restricted securities, providing transparency about potential stock dispositions. This signals either:

- Lack of confidencein the company’s future performance

- Liquidity needsor portfolio diversification requirements

- Planned profit-takingafter stock appreciation

The form specifies the number of shares or dollar amount, allowing investors to gauge the significance of the intended sale relative to the insider’s total holdings and the company’s overall share structure [1].

Investors should compare Form 144 filings with:

- Upcoming earnings releases

- Product launches or corporate events

- Stock price performance trends

- Regulatory or legal developments

- A surge in Form 144 filings, especially by senior executives, can signal waning confidenceand may trigger sell pressure [1]

- Large-volume sales can increase supply, potentially exerting downward pressureon the stock price [1]

- Clustered filings by key executives may serve as a red flagfor deteriorating fundamentals [1]

- Isolated filings may reflect routine portfolio diversificationrather than bearish sentiment

- Sales tied to personal liquidity needs or estate planning don’t necessarily indicate company-specific concerns

- The 90-day sale window provides the market time to absorb selling pressure gradually [1]

While I was unable to locate the specific February 14, 2024 Form 144 filing details you referenced in my searches, for a major financial institution like Barclays, insider selling filings warrant particular attention due to:

-

Regulatory Environment: As a heavily regulated bank, Barclays faces unique compliance requirements that may influence insider transaction timing

-

Market Sensitivity: Large financial institutions are particularly susceptible to sentiment shifts related to:

- Interest rate movements

- Credit quality concerns

- Regulatory enforcement actions

- Macroeconomic conditions affecting banking sector

-

Strategic Context: Any insider selling at Barclays should be evaluated against:

- Current Basel III/IV capital requirements

- UK banking sector performance

- Brexit-related operational adjustments

- Competition within European banking

| Factor | Interpretation |

|---|---|

Single Filing |

May indicate personal liquidity needs; not necessarily bearish |

Multiple Filings |

Could signal broader insider concern; warrants closer monitoring |

Executive Sales |

Higher-profile sales by C-suite warrant more attention |

Sale Timing |

Sales before positive catalysts may indicate lack of confidence |

[1] 2iQ Research - “What Is SEC Form 144 and Why Is It Important for Investors?” (https://www.2iqresearch.com/blog/what-is-sec-form-144-and-why-is-it-important-for-investors-2024-10-23)

Note: If you have access to the specific filing details or can provide additional context about the Barclays Form 144 filing you referenced, I can provide a more targeted analysis of that particular transaction.

中国农产品价格低迷对农业板块上市公司业绩和估值影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.