How to Research High-Risk Biotech Sectors for Investment Positions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

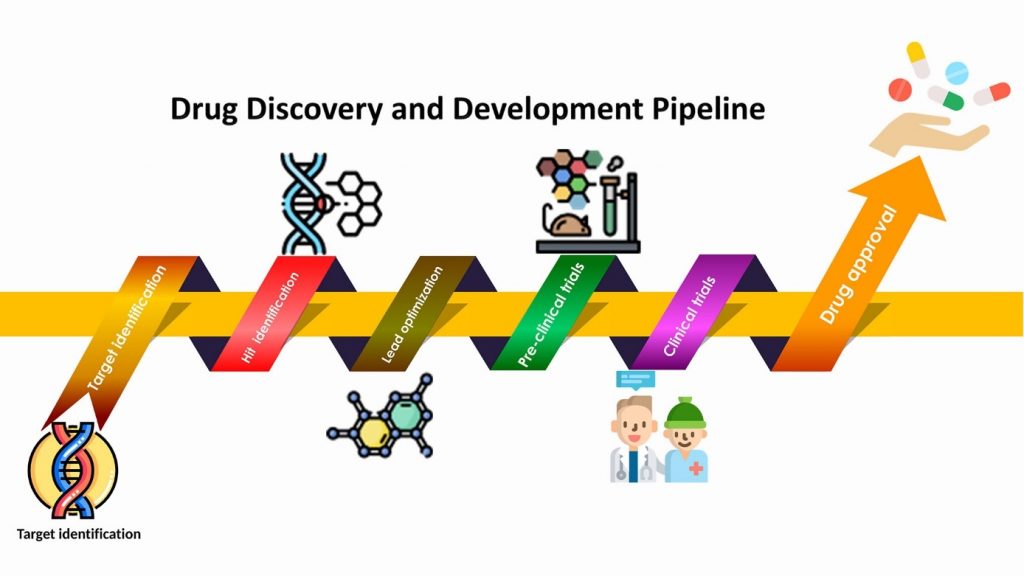

Effective biotech research relies on specialized tools to monitor drug pipelines and regulatory milestones. Key platforms include Catalyst Calendar [1], which offers dashboard access to catalyst events, and FDA Tracker [2], providing detailed trial phase and approval timeline data. BiopharmIQ [3] combines pipeline tracking with real-time social media updates, while ClinicalTrials.gov [4] remains the gold standard for official clinical trial information. Modern software integrates AI-driven analytics to predict trial outcomes and stock impacts [5].

Assessing cash runway is critical for early-stage biotechs. Investors calculate runway using monthly burn rate divided by current cash reserves [6,7,8]. This involves analyzing operating cash flow patterns, accumulated deficits, and equity financing history [6]. Pre-commercial firms are valued based on clinical milestones rather than traditional revenue metrics [6].

Social media platforms like BiopharmIQ’s Twitter [3] offer real-time updates on catalyst events and their market impact [5]. These insights help investors stay informed about emerging opportunities and risks.

For high-risk biotech investments, strategies include focusing on companies with strong cash reserves [6,7,8], tracking regulatory milestones [1,2,4], and considering venture capital-backed firms with disruptive potential [10,11,12]. Diversification across etfs and careful monitoring of clinical trial results are also recommended.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.