Successful Day Traders: Structured Routines & Key Practices (Reddit + Research Insights)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

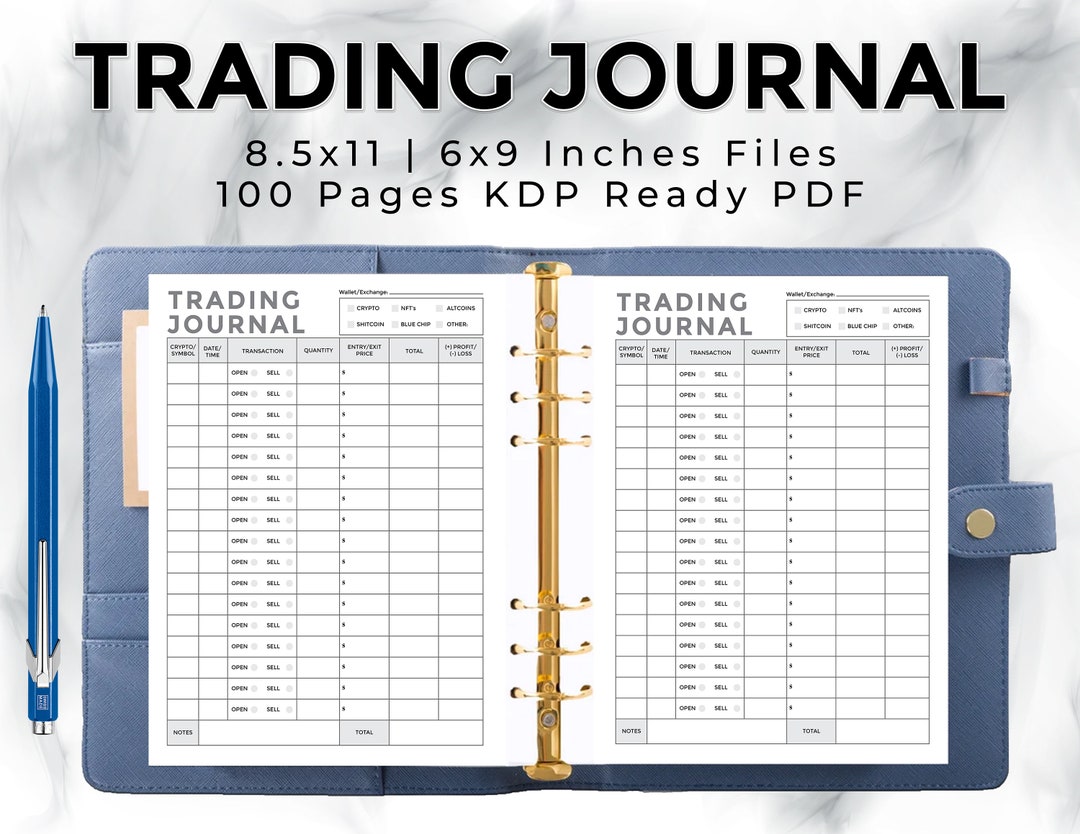

According to Reddit users [0], successful day traders often focus on short, high-volume windows (e.g., first 30 minutes of market open) and use alerts to minimize active screen time. Key practices include strict risk management, daily journaling to refine strategies, and intentional work-life balance (e.g., unplugging completely on weekends). Some users note that long-term success does not correlate with extended screen time, while others caution against scams involving trading courses or mentorship.

Structured routines are a cornerstone of successful day trading [1]. Pre-market preparation (2–4 hours before opening, typically 5:30–7:00 AM ET) involves analyzing economic calendars and chart levels [2][3]. Active trading is concentrated in high-volume windows (9:30–10:00 AM and 3:00–4:00 PM ET) [3], with post-market review completing the daily cycle [1]. Weekends include 2-hour Sunday planning sessions (chart analysis, risk assessment) and structured trade reviews [2], alongside physical activity for mental health [6].

Both Reddit insights [0] and research [1][3] align on the importance of focused active trading (not 8-hour days) and work-life balance. Reddit adds real-user examples (e.g., 30-minute trading windows, alert usage), while research provides specific timeframes and structured steps (e.g., pre-market prep duration). Implications: Success relies on discipline and routine rather than constant screen time—investors should prioritize prep/review and avoid overtrading.

- Risks: Overtrading (contrary to focused routines), neglecting risk management (a critical Reddit/research point), and burnout from poor work-life balance [6].

- Opportunities: Adopting structured pre/post-market routines [1], leveraging high-volume windows [3], using journaling to refine strategies [2], and cautious mentorship (avoiding scams per Reddit).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.