Analysis of Reddit Claim: Stocks vs Homeownership as Primary Wealth Driver

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

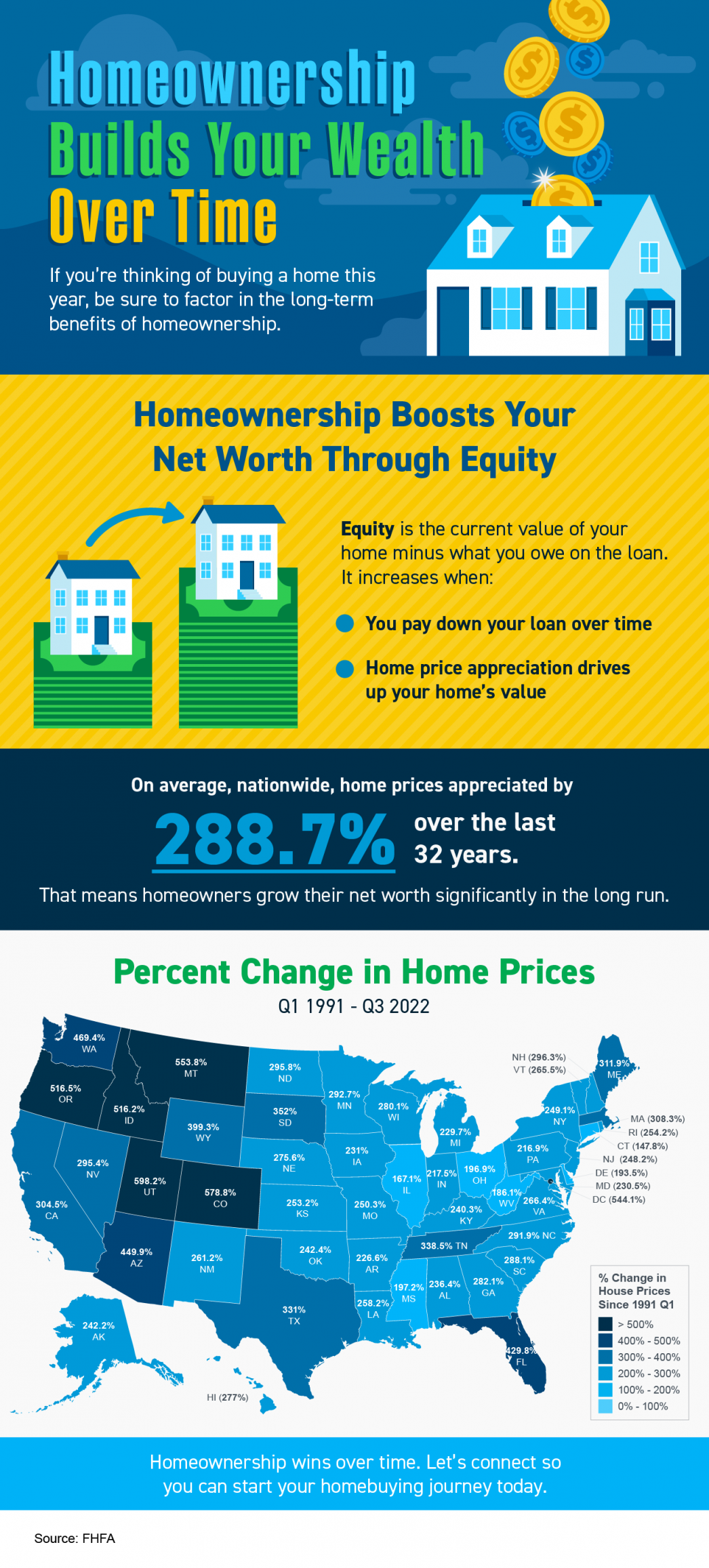

This analysis stems from a Reddit post [5] arguing stocks are the primary wealth driver over homeownership. Data reveals NASDAQ Composite delivered a 945.95% return (2005-2025) [0], while Case-Shiller home prices rose ~90% over the same period [1][2]. However, broader stats show homeowners have 40x higher median net worth than renters ($400k vs $10k) [3], a gap explained by scenario specificity: the 4x claim applies only to renters who consistently invest the “homeownership premium” (down payment + monthly savings) [4]. Factors like mortgage leverage, tax benefits, and maintenance costs further complicate comparisons [0].

- Scenario-Dependent Claims: The 4x wealth edge is not universal—it assumes renters invest savings, whereas most renters do not [3].

- Behavioral Factors: Homeownership forces equity accumulation via mortgage payments, while renters require discipline to invest consistently [4].

- Tech Sector Skew: NASDAQ’s exceptional returns are driven by tech growth, which may not be sustainable long-term [0].

- Risks: Equity volatility (NASDAQ 1.39% daily volatility [0]) can erase gains; housing downturns may lead to negative equity [1].

- Opportunities: Diversification (combining homeownership with stock investments) mitigates risks; leveraging tax benefits (mortgage interest deduction for homeowners, capital gains for investors) enhances returns [0][3].

- NASDAQ (2005-2025): +945.95% return [0].

- Case-Shiller Home Prices (2005-2025): +~90% [1][2].

- Median Homeowner Net Worth: $400k; Median Renter Net Worth: $10k [3].

- Scenario-Dependent Renter-Investor Outperformance: Up to 4x [4].

The optimal strategy depends on individual circumstances (risk tolerance, income, location) rather than a one-size-fits-all approach.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.