Analysis of Reddit Post Claiming Stocks Outperform Homeownership as Primary Wealth Driver

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

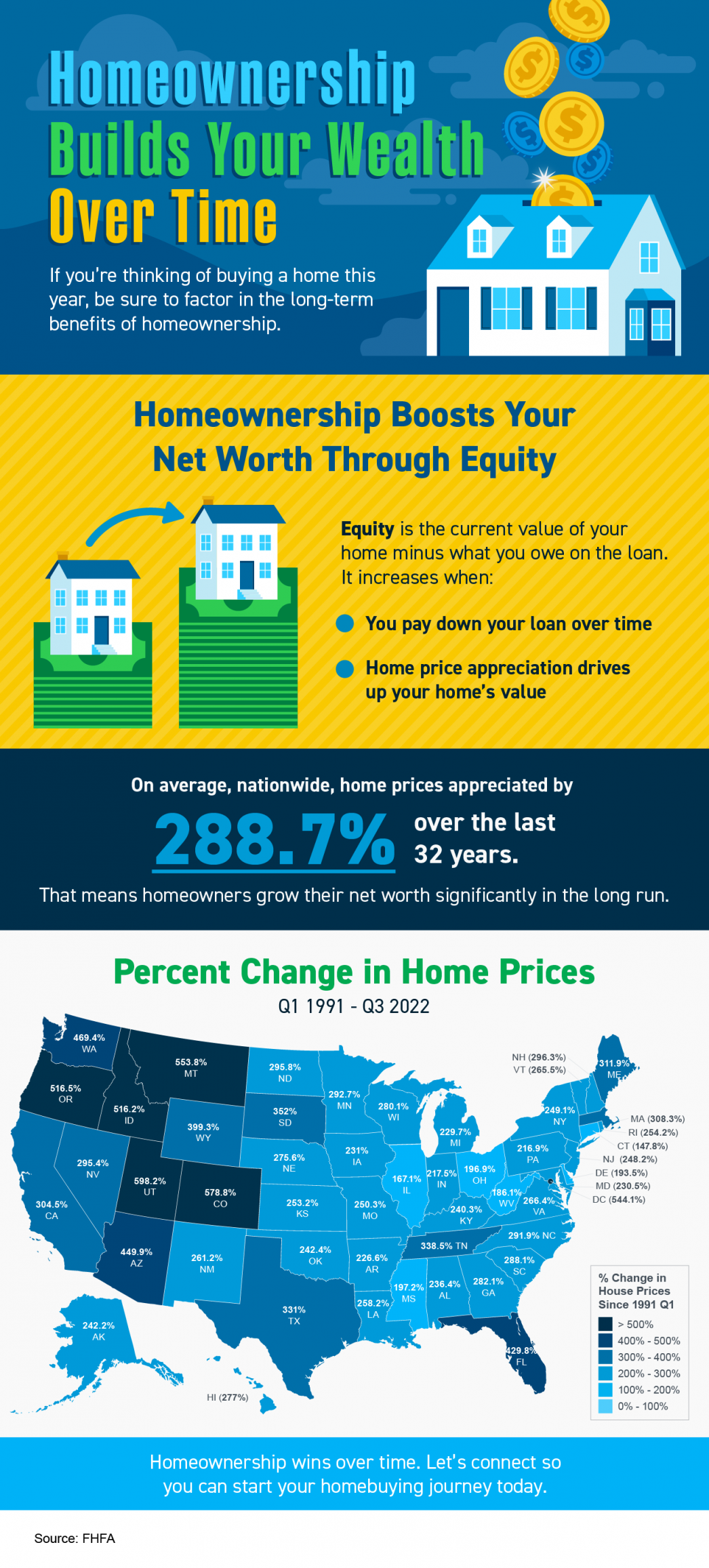

This analysis is based on a Reddit post published on November 16, 2025, which argues that stocks (especially U.S. tech indices) are the primary wealth driver compared to homeownership [1]. The post claims renters who invest in stocks accumulate ~4x more wealth than mortgage buyers. Historical data supports the higher return potential of stocks: the S&P500 has averaged ~10% annual returns vs. housing’s 4-8% [2], and the Nasdaq Composite delivered a 2111% return over 30 years (1995-2025) vs. S&P500’s 1008% [3]. A $153,500 investment in the S&P500 (1995–2024) grew to ~$3.4 million, while the same amount in a home appreciated to $503,800 [4]. Current affordability data (June 2025) shows renting is cheaper than buying in 49/50 top U.S. metros, with an average monthly gap of $908 [5]. However, homeownership offers equity building: homeowners who bought in 2006 gained $169k in equity by 2024, while renters lost $229k [8].

- The Reddit post’s 4x wealth claim assumes ideal investment behavior (consistent reinvestment of rental savings) and overlooks location-specific homeownership benefits (e.g., Pittsburgh PA where buying is affordable [5]).

- Leverage in homeownership (20% down payment controlling a full asset) can magnify returns if prices rise, a factor not considered in the post’s claim.

- Wealth gap metrics show homeowners have a median net worth of $400k vs. renters’ $10.4k (2024 Fed data [7]), indicating homeownership’s role in long-term wealth accumulation.

- Risks: Overexposure to tech indices carries volatility risk (Nasdaq’s historical 30%+ annual declines [3]). Dismissing homeownership may overlook equity-building opportunities for risk-averse investors [7].

- Opportunities: Renters in high-cost areas can leverage lower monthly costs to invest in stocks, while homeowners can benefit from tax deductions and rental income potential [6].

The analysis highlights the trade-offs between stocks and homeownership as wealth drivers. Stocks offer higher historical returns and liquidity, while homeownership provides stability and equity building. The Reddit post’s claim of 4x wealth accumulation is context-dependent, requiring ideal investment behavior and ignoring location-specific factors. Decision-makers should consider personal circumstances, risk tolerance, and market conditions when evaluating these options.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.