Market Sell-Off Analysis: Tech/AI Froth and Sector Rotation Trends (Nov 18, 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

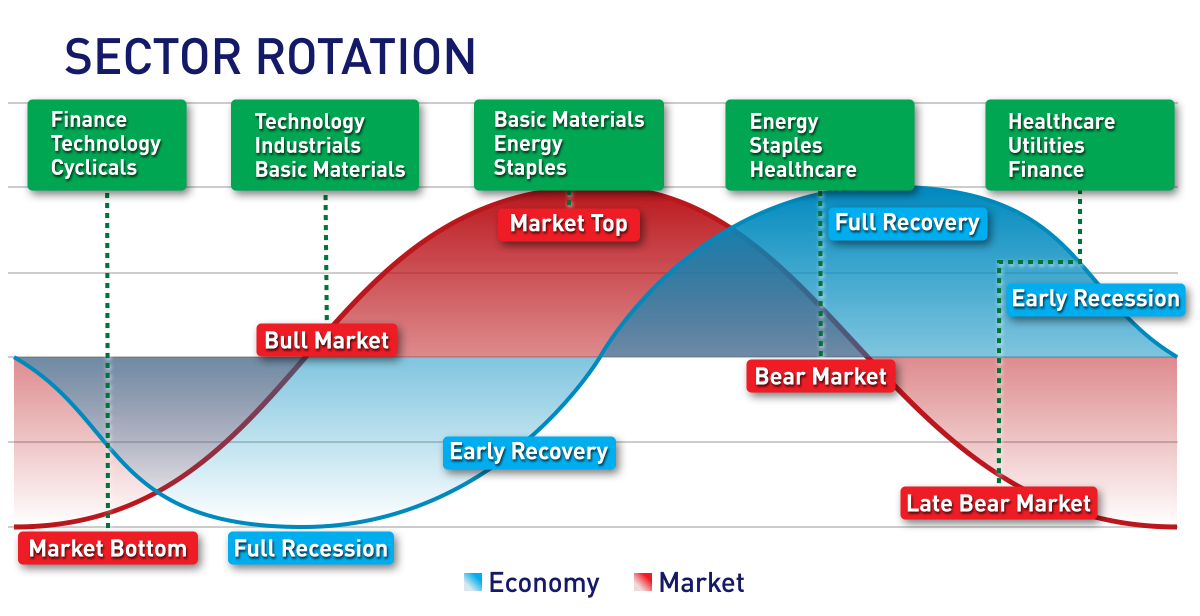

This analysis is based on a Barrons article [1] and internal market data [0]. On Nov 18, 2025, U.S. markets saw mild declines: S&P 500 (-0.04%), NASDAQ (-0.14%), Dow (-0.41%) [0]. Sector performance aligned with tech froth claims: tech sector down (-0.03774%), while energy (+2.689%) and utilities (+1.863%) led gains [0]. Tech stocks showed mixed results: NVDA (-0.17%), MSFT (+0.01%), AAPL (-0.66%) [0]. This signals potential sector rotation from tech to defensive/commodity sectors.

- Sector rotation from tech to energy/utilities is evident amid mild sell-off.

- Mild tech decline suggests cooling of AI valuations rather than a major crash.

- Energy/utilities outperformance reflects investor preference for stability.

- Risks: Tech valuation froth warrants monitoring for further corrections; overexposure to tech may increase risk.

- Opportunities: Energy/utilities sectors present potential alternatives to tech.

- Note: No strong crash indicators, but caution is advised for tech-heavy portfolios.

The Barrons article’s full content is unavailable (information gap), but internal data confirms mild tech sell-off and sector rotation. Key metrics: tech sector down (-0.03774%), energy up (+2.689%), NVDA (-0.17%), AAPL (-0.66%) [0]. Monitor tech trends, energy sector drivers, and complete Barrons article content for deeper insights.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.