Analysis Report: Reddit Post Claims Oracle & Vertiv AI Infrastructure at Risk

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

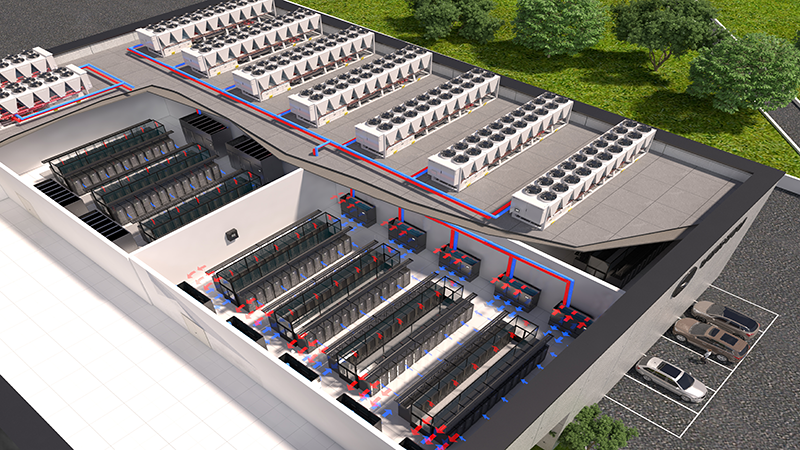

On November 18, 2025, at 20:35 EST, a Reddit post argued that Oracle (ORCL) does not believe in its own AI infrastructure due to inefficient cooling systems that will lead to rapid obsolescence. The post recommended buying put options on ORCL and Vertiv (VRT) as a bearish bet on the AI infrastructure sector [7].

- ORCL: Closed with a small after-hours gain of +0.29% ($220.49 vs. previous close $219.86) post-event, indicating limited immediate bearish reaction [0].

- VRT: Dropped -1.07% ($164.86 vs. previous close $166.65) in after-hours trading, outpacing its Industrials sector’s -0.16% decline that day [1,6].

- ORCL: Has lost 24.31% of its value in the past month, suggesting ongoing investor concerns about its AI strategy [2].

- VRT: Remains up 21.50% over 3 months, driven by strong demand for data center infrastructure [3].

- Bullish: Analysts maintain a “Buy” consensus for both stocks (ORCL:59.5% Buy; VRT:94.7% Buy) with significant upside targets (ORCL: +65.5% to $365; VRT: +18.9% to $196) [2,3].

- Bearish: The Reddit post adds to existing worries about ORCL’s $300B OpenAI deal, which has coincided with a $315B market cap loss [4].

| Metric | ORCL | VRT |

|---|---|---|

| Market Cap | $618.54B | $63.03B |

| P/E Ratio | 51.16x (elevated valuation) | 62.21x (very high valuation) |

| 1-Month Performance | -24.31% (significant decline) | -5.25% (moderate pullback) |

| Critical News | CDS spreads may signal AI risk | Collaborating with Caterpillar on cooling solutions [5] |

- Directly Impacted: ORCL (NYSE), VRT (NYSE).

- Related Sectors: Technology (ORCL), Industrials (VRT).

- Supply Chain: Data center infrastructure (cooling, power systems).

- Unsubstantiated Claim: The Reddit post’s assertion about inefficient cooling lacks concrete evidence. Further research into Oracle’s data center cooling efficiency reports is needed.

- Next-Day Trading: No data available for November 19, which would show the full market reaction to the post.

- VRT’s Cooling Solutions: Need to verify adoption rates of VRT’s new cooling products (from the Caterpillar collaboration) to assess obsolescence risk.

- Bearish View: High P/E ratios and ORCL’s recent market cap loss suggest valuation bubbles in AI infrastructure.

- Bullish View: VRT’s strategic partnership with Caterpillar directly addresses cooling inefficiencies, and Oracle’s Exascale Infrastructure (promoted in its blog) contradicts claims of self-doubt [4].

- Valuation Risk: Both stocks trade at elevated P/E ratios (ORCL:51x, VRT:62x), making them vulnerable to market corrections [0,1].

- ORCL’s AI Strategy: The $300B OpenAI deal has not delivered expected returns, and credit default swaps may signal growing concern [4].

- Mitigation: VRT’s collaboration with Caterpillar reduces the risk of cooling-related obsolescence [5].

- VRT’s cooling solution adoption rates post-Caterpillar partnership.

- Oracle’s next earnings report (to assess AI infrastructure ROI).

- Further movement in ORCL’s credit default swaps.

- Users should be aware that ORCL’s 24.31% 1-month decline and high P/E ratio may indicate significant valuation risk [2].

- This development raises concerns about unsubstantiated social media claims influencing market sentiment, which warrant careful consideration [7].

[0] Real-Time Quote: ORCL (Tool 0)

[1] Real-Time Quote: VRT (Tool1)

[2] Company Overview: ORCL (Tool2)

[3] Company Overview: VRT (Tool3)

[4] Ticker News: ORCL (Tool4)

[5] Ticker News: VRT (Tool5)

[6] Sector Performance (Tool6)

[7] Reddit Post: “oracle doesn’t even believe in themselves” (Event Content, 2025-11-18)

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always consult a licensed financial advisor before making decisions.

Last Updated: 2025-11-19 02:47 UTC

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.