Analysis of Trader Discussion on Price Structure Formation for XAUUSD

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

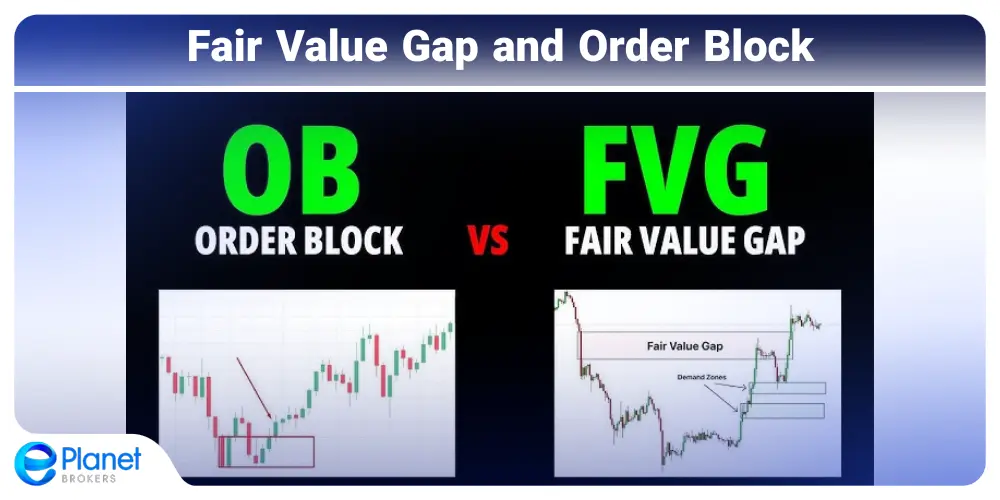

The Reddit discussion (2025-11-22 UTC) centers on a critical gap: most traders fail to recognize price moves are driven by liquidity pools, sweeps of highs/lows, and imbalances rather than randomness [0]. An XAUUSD trader advocates for structure-based trading (focusing on liquidity sweeps, break of structure, fair value gaps, order blocks, and session highs/lows) over indicators like RSI or MACD, noting this approach reduces random entries and tightens risk [0]. This aligns with industry trends: ACY Securities’ guide outlines a 6-step Smart Money Concepts (SMC) flow for XAUUSD, including session-specific execution (London:12AM-6AM EST, NY:9:30AM-12PM/1PM-4PM EST) [1]. Bookmap research confirms markets with clear structure see up to a 35% volume surge during breakouts, indicating institutional participation [2].

- Indicator Misuse: Traders often use indicators to predict moves, but their true value is identifying market conditions—combining with structure-based strategies improves effectiveness [0].

- Institutional Alignment: Structure-based strategies align with institutional activity (volume surges), making them relevant for liquid assets like XAUUSD [2].

- Timeframe Synergy: Higher timeframes for bias and lower for execution reduces noise, a point echoed in both the discussion and industry resources [0,1].

- Cultishness vs. Utility: ICT concepts have utility for gold futures but require filtering out non-applicable elements [0].

- Complexity: Structure-based trading (SMC) requires mastery of advanced concepts leading to potential losses for beginners [1].

- Overreliance: Ignoring fundamentals (e.g., Fed policy for gold) exposes traders to unforeseen shifts [1].

- Anecdotal Evidence: The discussion reflects a single trader’s experience, lacking generalizability [0].

- False Signals: Even in liquid markets, false breakouts occur during low-volatility sessions [1].

- Adoption Traction: Growing sentiment toward SMC for XAUUSD creates opportunities to refine these strategies [1,2].

- Liquid Asset Fit: Structure-based strategies are well-suited for XAUUSD, crude oil, and S&P 500 futures [4,5].

- Framework Integration: Combining SMC with fundamental analysis can mitigate risks and improve trade quality [1].

Structure-based trading (focused on liquidity pools and market structure) is gaining traction among XAUUSD traders, aligning with industry guides and institutional activity patterns. Traders should prioritize learning advanced concepts, balancing technicals with fundamentals, and focusing on high-volume sessions to reduce noise. The shift from indicator prediction to condition identification and structure analysis represents a meaningful evolution in trading methodologies for liquid assets.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.