Analysis of XAUUSD Structure-Based Trading vs Indicator Reliance in Reddit Discussion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit post (title: Most traders don’t understand how price actually forms structure) [0] published on 2025-11-22, where an XAUUSD trader discusses structure-based trading strategies.

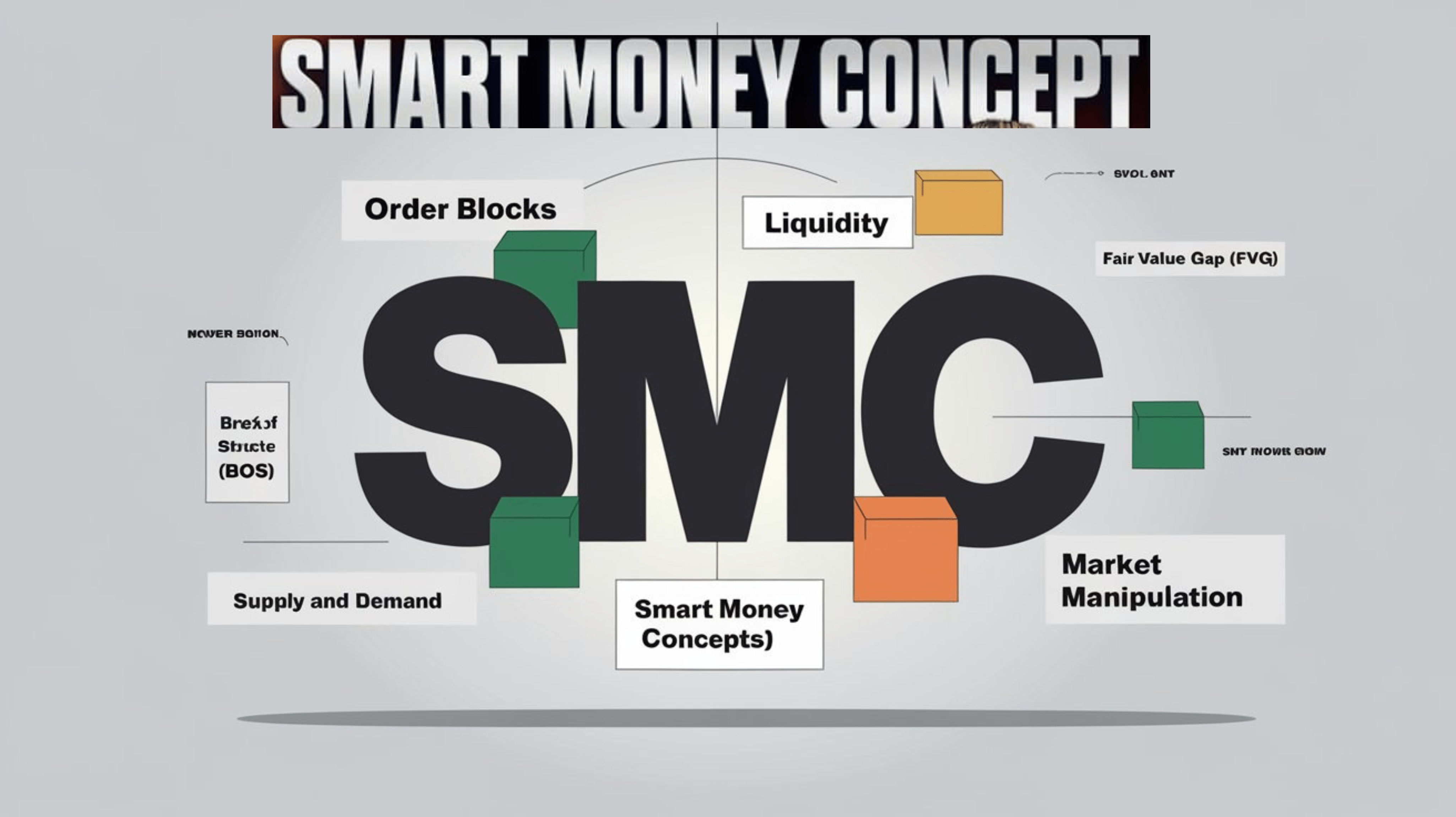

The Reddit trader’s advocacy for structure-based trading (focused on liquidity sweeps, order blocks, fair value gaps/FVGs, break of structure (BOS), and session highs/lows) aligns with Smart Money Concepts (SMC) and Inner Circle Trader (ICT) frameworks [1]. Lagging indicators like RSI and MACD are dismissed as they rely on past data, whereas structure-based approaches identify future price levels targeted by institutions [3]. For XAUUSD, the Asian session (11 PM–8 AM GMT) offers cleaner entries due to lower noise and predictable liquidity patterns [2]. FVGs have a 70–80% probability of being filled, providing reliable take-profit targets [3]. Risk management is tightened by placing stops at structural invalidation points (e.g., below order blocks) and limiting risk per trade to 0.5–1.5% [2].

- Strategy Alignment: Structure-based trading for XAUUSD is consistent with institutional order flow dynamics, making it suitable for traders seeking to align with smart money [1][4].

- Session Optimality: The Asian session’s low-volume environment reduces noise, enhancing the effectiveness of structure-based entry rules [2].

- Prop Firm Suitability: The strategy’s risk-bounded nature (0.5–1.5% per trade) and time-specific entries make it ideal for prop firm challenges [2].

- Hybrid Gap: While the trader dismisses indicators entirely, there is a lack of analysis on hybrid strategies combining structure with indicators (e.g., RSI for confirmation) for XAUUSD [3].

- Unverified Performance: The Medium article’s claimed 90% win rate is from a paid package and not independently verified [2].

- Volatility Adaptability: The strategy’s performance during extreme geopolitical shocks (a key driver of XAUUSD volatility) is unaddressed [5].

- Learning Curve: Structure-based trading requires mastery of SMC/ICT concepts, which may be steep for new traders.

- Consistency: FVGs’ 70–80% fill rate provides a measurable edge over indicator-based strategies [3].

- Risk Reduction: Structural stop placements minimize random losses compared to indicator-driven entries [2].

- Market Alignment: Aligning with institutional order flow can improve trade success rates in XAUUSD’s hybrid asset market [4].

- Core Concepts: Liquidity sweeps (stop-loss hunting), order blocks (institutional entry zones), FVGs (price gaps to fill), BOS (trend shift indicator) [1][3].

- Optimal Session: Asian session (11 PM–8 AM GMT) for XAUUSD structure-based trading [2].

- Risk Parameters: 0.5–1.5% risk per trade, stops at structural invalidation points, take-profits at FVG fill or next structural level [2][3].

- Data Gaps: Long-term performance data for the exact strategy and hybrid indicator-structure approaches are missing [2][3].

Note: The 90% win rate claim from the Medium article is from a paid strategy package and has not been independently verified. Traders should backtest any strategy before implementation.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.