NVIDIA Q3 FY26 Earnings Analysis: Strong Results vs. Mixed Market Sentiment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

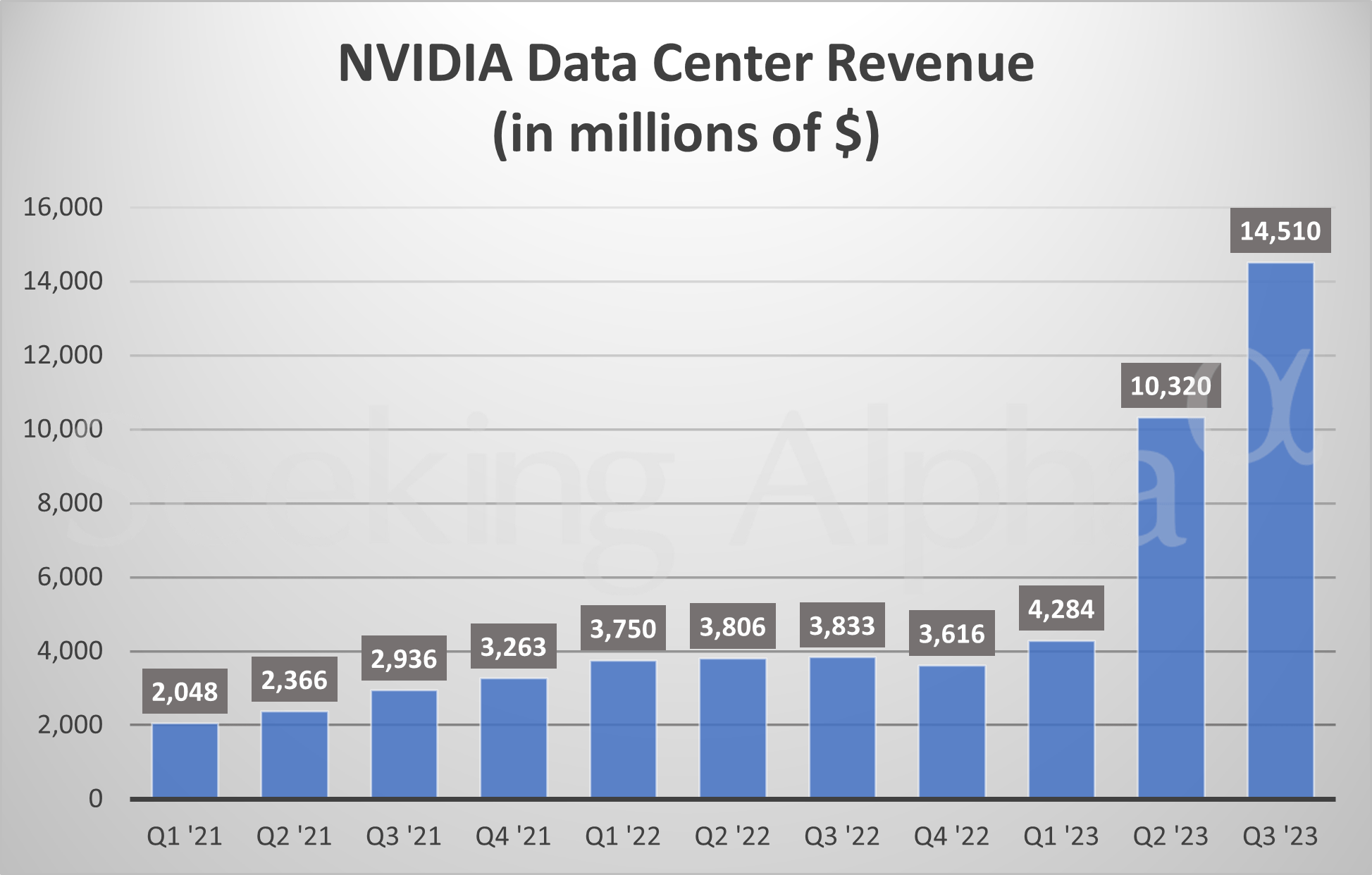

NVIDIA Corporation (NVDA) reported record Q3 FY26 earnings on November 19, 2025, with $57.0 billion in revenue (+62% YoY) and $31.9 billion in net income (+65% YoY). The Data Center segment drove growth ($51.2B, +66% YoY), and management guided Q4 FY26 revenue to $65.0 billion (±2%) [1][0]. Despite these strong results, NVDA’s stock dropped to $178.88 (-0.97% on 2025-11-23) amid mixed sentiment:

- Bearish Views: Customer concentration (61% of Compute & Networking revenue from 4 clients), valuation concerns (P/E ratio of 44.28x), and macro headwinds (inflation, rate uncertainty).

- Bullish Views: Long-term AI growth potential, analyst price targets of $220–$250, and record backlogs ($500B in purchase commitments through 2026) [0][2].

- Stock Performance: NVDA underperformed the Technology sector (which rose 0.146% on 2025-11-23) with a 0.97% drop. Over the past 30 days, the stock declined 4.84% (from $187.97 to $178.88) with increased volatility (daily standard deviation of 2.62%) [0].

- Volume: Trading volume reached 346.93M on 2025-11-23, 1.8x the 30-day average, indicating high investor activity [0].

- Valuation Disconnect: NVDA’s P/E ratio (44.28x) is above the S&P 500 average (≈20x), but 73.4% of analysts maintain a “Buy” rating with a consensus target of $250 (+39.8% from current price) [0].

- Sector Context: The Technology sector was the second-worst performer on 2025-11-23, reflecting broader caution toward growth stocks [0].

| Metric | Value | Source |

|---|---|---|

| Q3 FY26 Revenue | $57.0B (+62% YoY) | [1][0] |

| Q3 FY26 Net Income | $31.9B (+65% YoY) | [1][0] |

| Q4 FY26 Guidance | $65.0B (±2%) | [1][0] |

| Data Center Revenue | $51.2B (+66% YoY) | [1][0] |

| Customer Concentration (Compute & Networking) | 61% from 4 clients | [1] |

| Market Cap | $4.36T | [0] |

| P/E Ratio | 44.28x | [0] |

| 30-Day Price Change | -4.84% | [0] |

- NVIDIA (NVDA): Core stock affected by earnings and sentiment.

- Semiconductors: Suppliers like TSMC (TSM) and ASE Technology (ASX) may see indirect impact from NVDA’s supply chain decisions [0].

- AI/Data Center: Cloud providers (MSFT, AMZN, GOOGL) are major clients; their 2026 spending plans will influence NVDA’s growth [1][3].

- Accounting Allegations: A Substack report claims NVDA uses “xAI SPV structures” to inflate revenue and has a low cash conversion ratio (74.4%: $23.75B operating cash flow vs. $31.9B net income). NVIDIA has not officially responded [2].

- Customer Retention: No public updates on whether top clients (e.g., Oracle, Intel) will maintain purchasing plans amid macro headwinds [3].

- Customer Concentration: 61% of Compute & Networking revenue from 4 clients—loss of any could significantly impact earnings [1].

- Accounting Concerns: Low cash conversion ratio and inventory growth (32% QoQ) raise questions about revenue recognition [2].

- Macro Headwinds: November 2025 CPI nowcast (2.99% YoY) exceeds the Fed’s target, delaying rate cuts and pressuring growth stocks [4].

- NVIDIA’s Response: Official comments on accounting allegations.

- Fed Policy: December 2025 rate decision (minutes suggest caution toward cuts).

- Q4 Inventory: Alignment with “demand outpacing supply” claims [3].

- Client Spending: Updates from MSFT/AMZN on 2026 AI budgets.

[0] Ginlix Analytical Database (get_stock_realtime_quote, get_stock_daily_prices, get_company_overview, get_sector_performance)

[1] NVIDIA CORP Quarterly Earnings Report (10-Q)

[2] The Algorithm That Detected a $610 Billion Fraud

[3] NVIDIA Q3 FY26 Presentation

[4] Cleveland Fed Inflation Nowcasting

This analysis is for informational purposes only and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.