Century Therapeutics (IPSC) Analysis: iPSC Tech Potential, Market Dynamics & Risk-Reward

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

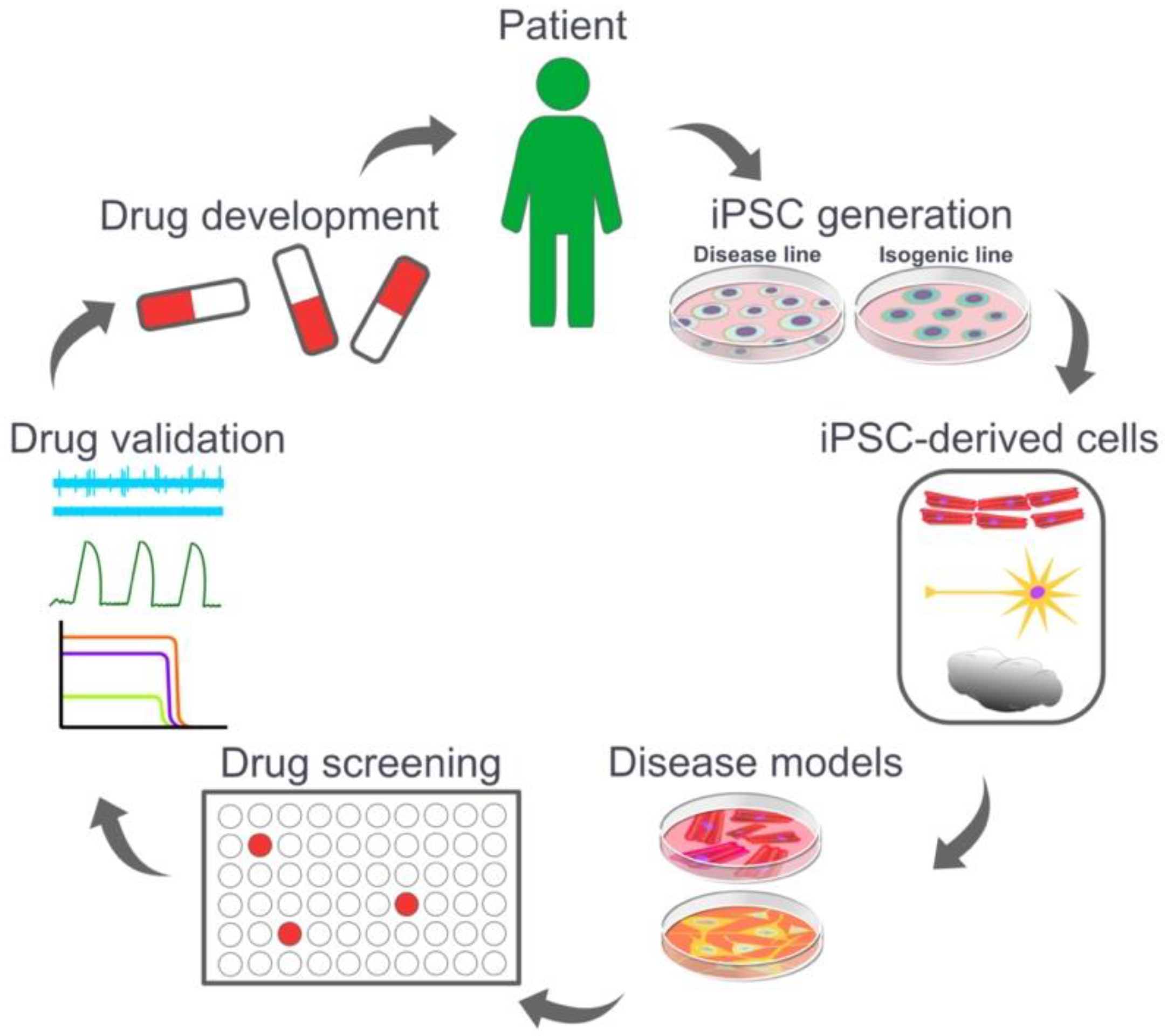

This report combines Reddit discussion insights [0] and market data [1,3] to evaluate Century Therapeutics (IPSC). Reddit users expressed positive sentiment toward IPSC’s iPSC-derived T1D cure potential, with some committing to invest [0]. Market performance shows 51.49% YTD return (vs S&P500’s12.26%) but Leerink Partners downgraded to ‘Hold’ (target $2 from $7) [0]. Financials: $430M market cap, $1.13B revenue, net loss $2648M, 7.05% gross margin [0]. The global iPSC market is projected to grow at9.9% CAGR (2024-2033) [0]. China’s dual-track regulatory framework supports cell therapy [0], and a Chinese team achieved a global first in ALS treatment using iPSC [4]. Domestic firms like华夏源 are advancing [5].

- Retail (Reddit) optimism about T1D cure contrasts with institutional caution (Leerink’s downgrade).

- IPSC’s stock growth aligns with iPSC industry expansion, but financial losses and insider selling raise concerns.

- China’s ALS breakthrough highlights iPSC’s global relevance, impacting IPSC’s competitive landscape.

- China’s regulatory support accelerates iPSC adoption, benefiting both domestic and global players.

Risks: Leerink’s downgrade, insider selling, limited liquidity (93.7k daily volume), ongoing losses [0].

Opportunities: iPSC’s multi-disease applications, global market growth, China’s policy support [0,4,5].

Century Therapeutics (IPSC) has strong YTD performance driven by iPSC tech potential. Retail sentiment is positive, but institutional caution and financial challenges persist. The global iPSC market is growing, with China leading in ALS treatment breakthroughs. Domestic Chinese firms are actively布局 iPSC tech.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.