AI Bubble Debate: Key Risks and Market Dynamics for Nvidia

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

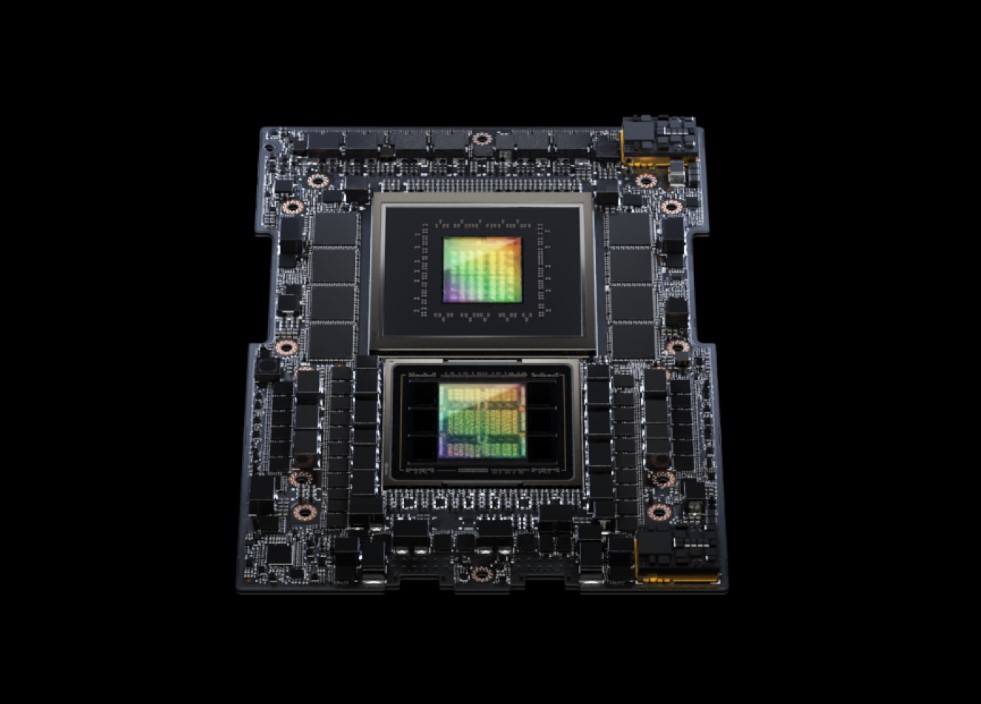

The Reddit debate on whether we are in an AI bubble highlights conflicting perspectives: pro-bubble arguments focus on return-on-investment (ROI) gaps for firms investing in AI infrastructure, while anti-bubble claims emphasize strong component demand (e.g., Nvidia’s GPU shortages) [original Reddit post]. Nvidia’s Q3 FY26 earnings report shows robust revenue growth (62% YoY to $57B) and data center revenue (66% YoY to $51.2B) [0], but its accounts receivable (AR) grew 45% from $23B to $33B in ~9 months [0]. This AR growth, though not drastically outpacing revenue, raises concerns about customer payment delays, aligning with Reddit comments about ‘IOUs’ [original Reddit post]. Competition risks are emerging: Meta is considering Google’s AI chips, and China’s Moore Threads is preparing for an IPO [2,3]. NVDA’s stock has exhibited volatility over 30 days, with a range of $172.93 to $212.19 and a -1.20% change [1], reflecting investor uncertainty about future growth.

Cross-domain correlations include: (1) Nvidia’s AR growth as an early indicator of potential cash flow constraints; (2) competition from Google and Chinese firms threatening Nvidia’s ~80% market share in AI GPUs; (3) the AI bubble debate’s parallel to the dot-com era, where demand for infrastructure didn’t translate to profits for many firms [original Reddit post]. Deeper implications: even with strong current component demand, if firms fail to realize ROI from AI investments, they may scale back spending, impacting Nvidia’s future sales.

Critical data points: Nvidia’s Q3 FY26 revenue ($57B), AR ($33B), 30-day stock volatility (range: $172.93-$212.19), and emerging competition from Google and Moore Threads [0,1,2,3]. The AI bubble debate centers on whether current component demand will translate to sustainable profits, with Nvidia’s performance serving as a key market indicator.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.