Analysis of Reddit Post: AI Market vs. Dot-Com Era Parallels

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

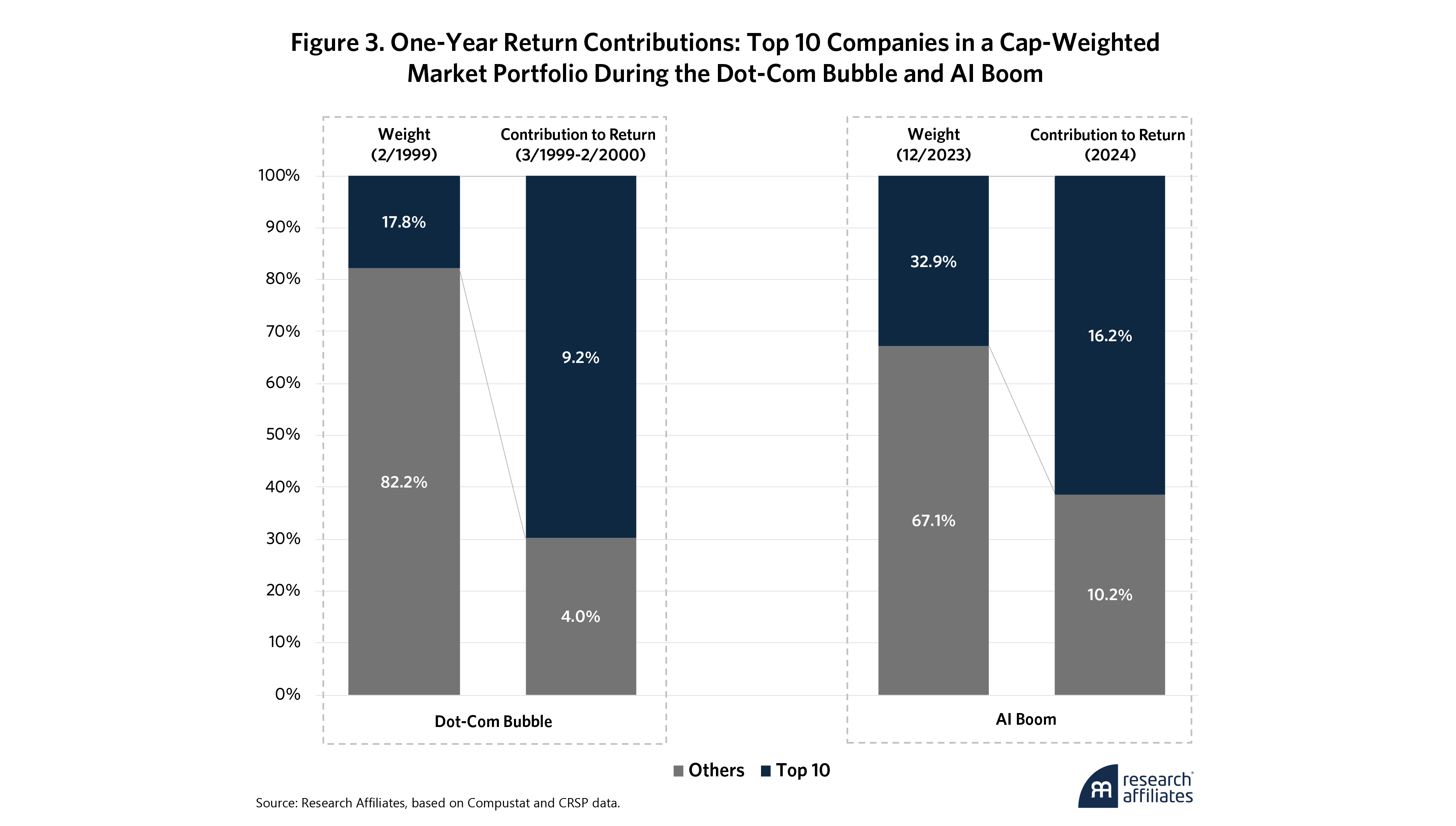

The Reddit post draws parallels between the current AI market and the dot-com era, but critical differences emerge: AI companies have real earnings (e.g., Microsoft’s P/E ratio of 33.5 [0]) unlike dot-com firms (many unprofitable [2]). Alphabet’s Gemini3 Pro, released in November 2025 and trained entirely on Google’s TPUs [1,5], highlights ongoing AI innovation. The S&P500 Shiller P/E ratio is near 40.4 [2], approaching dot-com peaks, but profitability mitigates bubble risks [0]. The Technology sector was up 2.08593% as of Nov 25, 2025 [7], supporting bull market continuation claims.

- Earnings Distinction: The core difference between AI and dot-com eras is real, consistent earnings from AI leaders like Google and Microsoft [0,2].

- AI Innovation Moat: Gemini3 Pro’s TPU training reduces Alphabet’s reliance on third-party chips (e.g., Nvidia), strengthening its competitive position [5,6].

- Valuation Context: Elevated Shiller P/E levels are balanced by profitable operations, unlike the dot-com era’s unprofitable startups [2,3].

- Risks: Valuation metrics approaching dot-com peaks (Shiller P/E ~40.4 [2]) signal potential volatility.

- Opportunities: AI innovation (Gemini3 Pro [1]) and profitable growth drivers support bull market continuation [0,7].

- AI Innovation: Gemini3 Pro released Nov 2025, trained on Google’s TPUs [1,5].

- Valuation: S&P500 Shiller P/E ~40.4 (dot-com peak:44.2) [2].

- Market Performance: Technology sector up 2.08593% (Nov25,2025) [7].

- Alphabet Stock: Google (GOOGL) hit all-time high on Nov24,2025 [4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.