AI Bubble Debate Analysis: Demand vs. ROI Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This report analyzes a Reddit discussion (2025-11-23 UTC) debating whether the AI industry is in a bubble. The original poster (OP) argues no bubble exists, citing RAM price hikes and Nvidia’s unmet GPU demand. Counterarguments focus on return on investment (ROI) concerns, potential misrepresentation of bubble definitions, and risks associated with Nvidia’s customer financing. Supplementary data from web searches confirms RAM price increases and Nvidia’s strong Q3 2025 performance, while expert analysis highlights ongoing industry debate about bubble risks.

a.

b.

c.

d.

e.

Web search results validate the OP’s claim of AI-driven supply chain strain:

- Contract prices for 32GB DDR5 modules jumped from $149 (September) to $239 (November), a 60% increase [1].

- Samsung raised memory chip prices by up to 60% since September, driven by AI data center buildouts [2].

This confirms robust demand for AI infrastructure components, supporting the OP’s argument against a bubble based on current supply-demand dynamics.

Nvidia’s Q3 2025 results show:

- Data center revenue climbed 66% to $51.22B, beating Wall Street estimates [3].

- CEO Jensen Huang explicitly addressed bubble fears in the earnings call, stating AI demand is “exponentially growing” across industries [3,4].

However, critics highlight circular financing risks: Bloomberg notes Nvidia may lend to customers to fund chip purchases, creating potential default risks if AI projects fail to generate returns [6]. The Reddit claim of IOUs (accounts receivable) remains unconfirmed by Nvidia’s public financial reports [3].

The core debate hinges on conflicting definitions of a bubble:

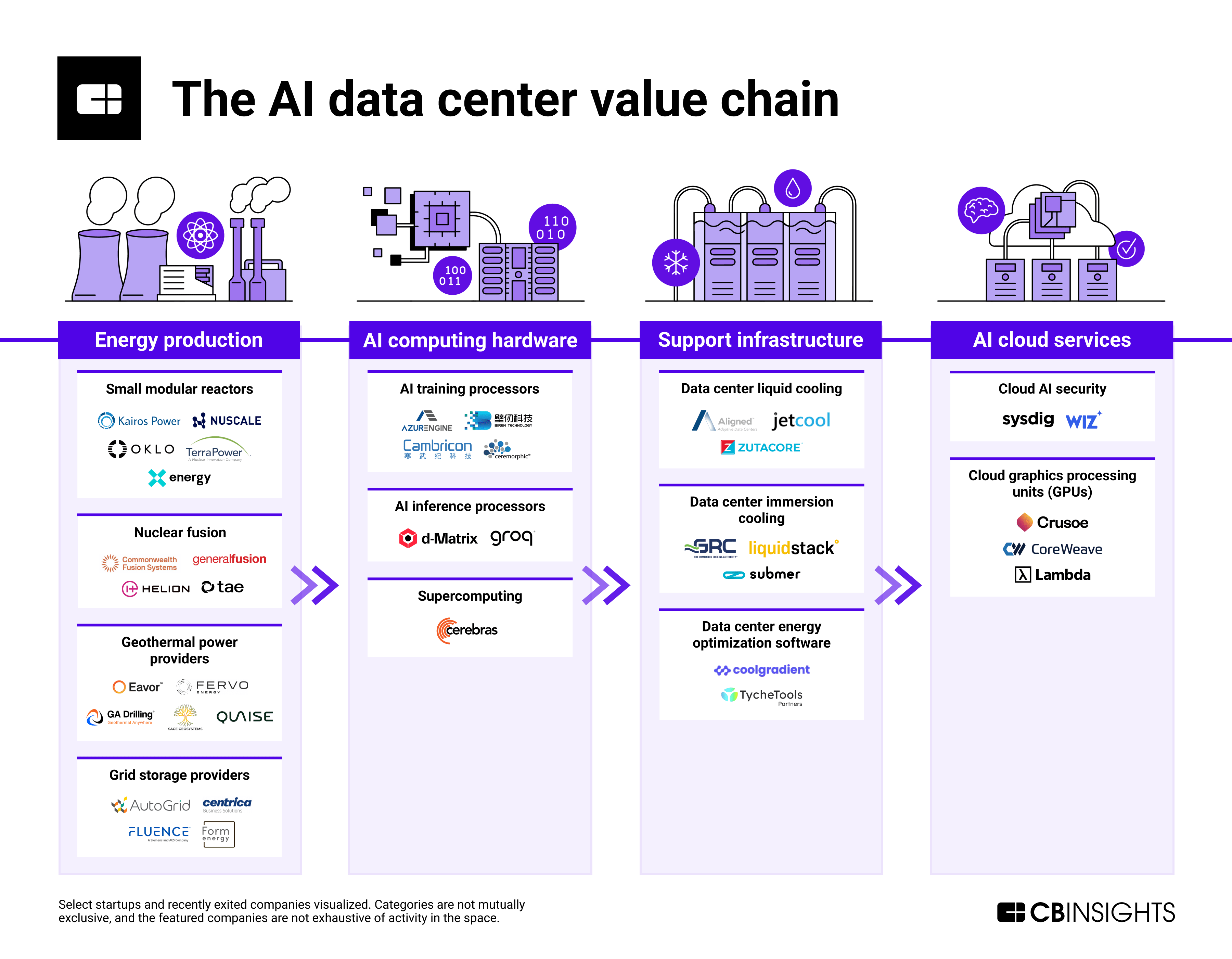

- OP’s View: Bubbles involve pre-revenue/non-product companies (e.g., Oklo nuclear startups), not current component demand [0].

- Critics’ View: Bubbles occur when demand does not translate to ROI, as seen in the dot-com era [0].

Forbes reports big tech firms (Amazon, Google, Meta, Microsoft) will spend $364B on AI infrastructure in 2025, but the question remains whether these investments will yield profitable returns [5].

- RAM Price Hikes: Higher memory costs increase barriers to entry for AI startups, potentially consolidating market power among big tech firms [1,2].

- Nvidia’s Stock Volatility: Nvidia’s stock rose 4.9% premarket post-Q3 results, but bubble concerns could lead to future volatility if ROI doubts persist [3,4].

- Circular Financing Risks: If Nvidia’s customer lending programs are widespread, defaulting customers could harm Nvidia’s balance sheet and disrupt the AI supply chain [6].

- Infrastructure Overcapacity: The $364B AI spend by big tech may lead to overcapacity if AI projects fail to deliver expected returns [5].

- Demand-Focused Investors: Will likely prioritize Nvidia and memory manufacturers (e.g., Samsung, Micron) due to strong current demand [1,3].

- ROI-Focused Investors: May avoid AI startups and focus on profitable AI-enabled companies (e.g., cloud providers) [4,6].

- RAM Price Change: DDR5 modules up 60% (Sept-Nov 2025: $149 → $239) [1].

- Nvidia Q3 Data Center Revenue: $51.22B (66% YoY growth) [3].

- Big Tech AI Infrastructure Spend: $364B (2025 fiscal year) [5].

- Bubble Definition Split: OP emphasizes pre-revenue firms; critics focus on ROI [0].

a.

b.

c.

d.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.