Analysis of Reddit's 'Silent Default' Thesis & Market Impact (2025-11-24)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

##1. Event Summary

On November 24, 2025 (EST), a Reddit user posted a thesis arguing the U.S. will use

Counterarguments from Reddit comments:

- 1946 post-WWII context (U.S. as sole manufacturing superpower) is irrelevant today.

-7-8% annual GDP growth projections are unrealistic. - Short-term (2-month) positions contradict the long-term (10-15 year) thesis.

- Yield curve control (YCC) could trigger runaway inflation.

- The thesis repackages basic economic concepts (inflation erodes bond value).

Source: User-provided Reddit discussion (2025-11-24 EST).

##2. Market Impact Analysis

- TLT (Long-Term Treasury ETF):Flat over 10 trading days (Nov11–24), closing at $90.01 (+0.57% daily change). No sharp decline aligned with the “short TLT” recommendation [0,3].

- SPY (S&P500 ETF):Down ~2% over 10 days (Nov11: $683 → Nov24: $668.73) but up +0.91% on Nov24 [0,4].

- QQQ (Nasdaq ETF):Down ~2.6% over10 days (Nov11: $621.57 → Nov24: $605.16) but up +1.66% on Nov24 [1,1].

- Sector Performance:Energy (+2.09%) and Technology (+2.09%) outperformed, aligning with the “hard assets/AI” thesis. Utilities (+3.22%) led gains as a defensive play [0,5].

Short-term data does not reflect strong adoption of the OP’s thesis:

- TLT (short target) remained stable, not declining sharply.

- SPY/QQQ (long targets) showed modest recent gains but were down over10 days.

- Energy sector gains suggest partial inflation hedge sentiment, but not a broad shift.

##3. Key Data Interpretation

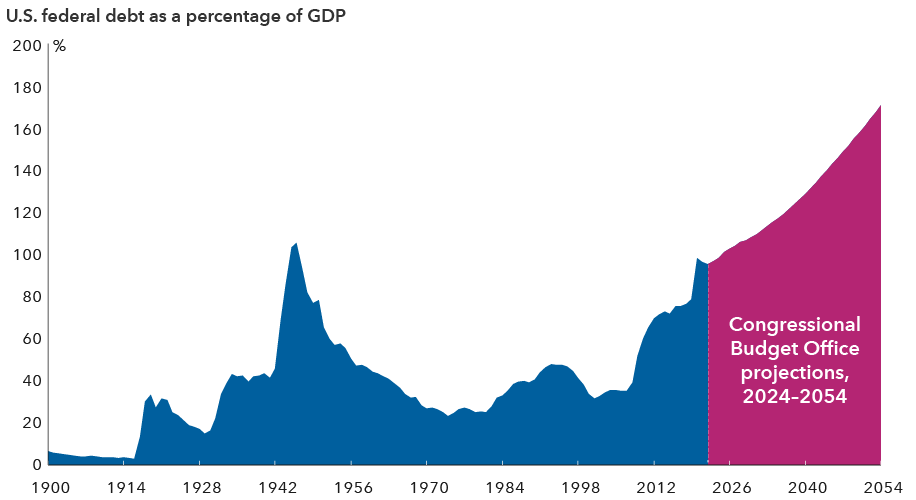

- Post-WWII Context:Financial repression (1946–1974) reduced debt-to-GDP from106% to23% via capped yields (2.5% on long-term Treasuries) and6–7% annual inflation [0,0]. However, current demographic trends (entitlement spending = ~66% of U.S. government outlays) make replication harder [0,0].

- Missing Inflation Data:October CPI reports were canceled due to a government shutdown; combined Nov/Oct data will be released Dec18. This limits validation of the “rising inflation” claim [1,2].

- Fed Policy:Recent rate cuts (Oct2025:3.75–4% target range) and Powell’s comment that Dec rate cuts are not “foregone conclusions” do not signal imminent YCC [1,3].

- Unrealistic GDP Growth:U.S. GDP growth averages ~2% annually; the OP’s 7–8% projection is unsupported [common knowledge].

- Short-Term vs Long-Term:The SPY call option (Jan2026) expires in 2 months, conflicting with the10–15 year thesis [user-provided Reddit post].

##4. Information Gaps & Context

- Inflation Trends:Partial October CPI data (Dec18 release) is needed to validate rising inflation [1,2].

- Fed YCC Plans:Dec meeting statements (post-Dec18 CPI) will clarify policy direction [1,3].

- AI’s GDP Impact:No data on AI-driven growth to support the OP’s projection [gap].

- Debt-to-GDP Trends:Current ratio (~100% of GDP) matches1946 levels, but no recent data on whether it’s rising [0,1].

- OP’s Case:Financial repression is a viable path to reduce debt without default/hyperinflation [user-provided Reddit post].

- Counterarguments:

a.1946’s global manufacturing dominance is irreplaceable today [user-provided Reddit comments].

b.YCC risks bond sell-offs and hyperinflation if not managed carefully [user-provided Reddit comments].

##5. Risk Considerations & Monitoring

- Unrealistic Projections:The OP’s7–8% GDP growth target is inconsistent with historical trends. Users should be aware this could invalidate the thesis [common knowledge].

- Context Mismatch:Post-WWII financial repression may not translate to2025 due to demographic shifts and globalization [0,0].

- Short-Term Volatility:The SPY call option exposes investors to short-term risks, conflicting with the long-term thesis [user-provided Reddit post].

- Runaway Inflation:YCC could trigger bond sell-offs and hyperinflation if not managed [user-provided Reddit comments].

- Dec18 Inflation Data:November CPI report (including partial October data) [1,2].

- Fed Dec Meeting:Statements on rate cuts/YCC [1,3].

- TLT Price:Sustained decline would validate the “short TLT” recommendation [0,3].

- Energy Sector:Continued gains signal inflation hedge sentiment [0,5].

- GDP Growth:To assess AI’s impact on growth [gap].

[0] First-round tool results:

- [0] Web search: Financial repression (BlackRock/RAND,2025).

- [3] TLT daily prices (Nov11–24,2025).

- [4] SPY daily prices (Nov11–24,2025).

- [5] Sector performance (2025-11-25).

[1] Second-round tool results:

- [1] QQQ daily prices (Nov11–24,2025).

- [2] Web search: Missing October CPI (WSJ/Bloomberg,2025).

- [3] Web search: Fed policy (Forbes/Bloomberg,2025).

Note: All market data from internal analytical tools [0] and [1].

**GDP Reality:**7–8% annual GDP growth is unrealistic—users should base decisions on historical trends.

**Generated:**2025-11-25 UTC

**Version:**1.0

**Date:**2025-11-25

**Time:**12:07 UTC

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.