Analysis of Price Limit Up Drivers and Market Impact for Yingxin Development (000620)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

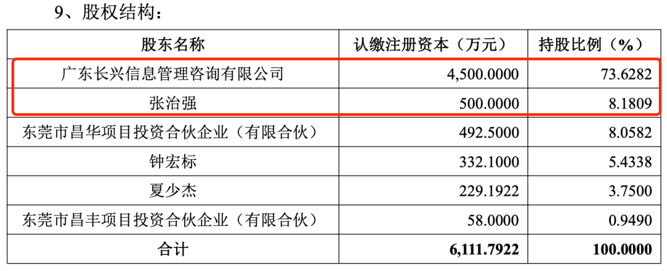

Yingxin Development (000620) hit the price limit up on November 25, 2025. The core driver is the company’s plan to acquire an 81.8091% stake in Guangdong Changxing Semiconductor to enter the memory chip packaging and testing sector [5][6]. The target of the acquisition is a high-tech enterprise engaged in memory chip packaging and testing, which aligns with the hot trends in the semiconductor industry in 2025 [9]. The memory chip industry has broad market prospects in 2025, with an expected scale of 458 billion yuan [9], and the demand for advanced packaging technology is strong, providing industry background support for this stock [0].

The company’s historical financial data shows alternating profits and losses [4], but the expectation of this transformation has attracted market attention, pushing the stock price up by over 60% in a week [6]. From the perspective of stock price performance, it has shown a trend of consecutive price limit ups recently, and the short-term market sentiment is positive [2].

- Resonance between M&A Restructuring and Industry Hotspots: Yingxin Development is transforming from traditional businesses to the semiconductor memory packaging and testing sector, coinciding with the recovery of the memory chip industry’s prosperity, forming a market expectation gap [0][9].

- Divergence Between Fundamentals and Valuation: Although the company’s fundamentals are weak, the transformation imagination space brought by the M&A event has significantly increased the valuation level [4][6].

- Support from Technological Trends: Advanced packaging technology has become an important development direction in the semiconductor industry chain, and the technical capabilities of the acquisition target are expected to bring a new growth curve to the company [9].

- M&A Uncertainty: The acquisition needs regulatory approval and negotiation between the two parties, and there is a risk that it cannot be completed smoothly [0].

- Integration Risk: The company lacks operational experience in the semiconductor industry, and the integration of the target assets is highly difficult [0].

- Fundamental Pressure: The original business performance is weak, and if the transformation is not as expected, the stock price may correct [4].

- Industry Growth Dividend: The memory chip market scale is expected to continue to expand, and if the acquisition is successful, the company is expected to share the industry growth benefits [9].

- Continuation of Short-term Sentiment: The market has a high degree of attention to semiconductor M&A events, and the short-term stock price may remain strong [2].

- Core Event: Yingxin Development plans to acquire an 81.8091% stake in Guangdong Changxing Semiconductor to layout the memory chip packaging and testing sector [5][6].

- Stock Price Performance: The stock price surged by over 60% in a week, showing a trend of consecutive price limit ups [2][6].

- Industry Background: The memory chip industry scale is expected to reach 458 billion yuan in 2025, and the demand for advanced packaging technology is strong [9].

- Risk Reminder: The M&A matter has uncertainties, and investors need to pay attention to subsequent progress announcements [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.