Analysis of Leike Defense (002413) Limit-Up Event and Its Impact on the Military Industry Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Leike Defense (002413) hit the limit-up on November 25, 2025, with the stock price reaching 7.01 yuan, a gain of 10.05%, and a turnover of 1.129 billion yuan [0]. Previously, the company issued an abnormal fluctuation announcement due to cumulative deviation from the rise value exceeding 20% in three consecutive trading days, clarifying its operating conditions [1]. Dragon and Tiger List data shows active participation by hot money, with well-known brokerage branches such as Shanghai Zhongshan East Road appearing [2], reflecting short-term market speculative sentiment.

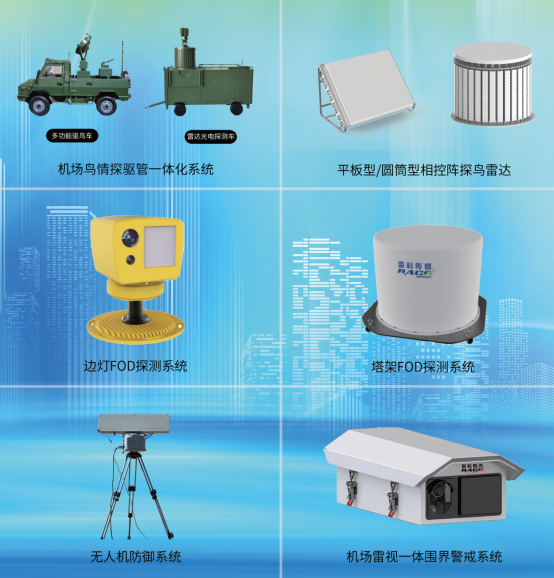

The company belongs to the military electronics sector and mainly engages in radar systems, defense equipment, and other businesses [0]. The military industry sector performed strongly overall in 2025, benefiting from increased defense spending and rising demand in sub-sectors such as electronic warfare and radar [5]. Globally, the European arms industry is expected to grow by over 10% annually [6], and the military cybersecurity market will reach 52 billion US dollars by 2034 [7], indicating a long-term growth trend for the industry.

- Resonance between Hot Money and Industry Trends: Hot money participation drove the short-term limit-up, while the long-term prosperity of the military sector provided fundamental support, forming a superimposed effect of short-term speculation and long-term value.

- Transmission of Global Defense Demand: The growth of the European arms industry and the expansion of the cybersecurity market reflect the rising trend of global defense spending, which indirectly benefits domestic military enterprises.

- Abnormal Fluctuation Signal: Cumulative deviation from the rise value of 20% triggered a regulatory announcement, prompting short-term fluctuation risks; follow-up regulatory dynamics need to be watched.

- Risks: Short-term withdrawal of hot money may lead to stock price fluctuations [2]; regulatory attention triggered by abnormal fluctuations may increase trading restrictions [1]; short-term overvaluation risk of the military sector [5].

- Opportunities: Continuous growth of the defense budget brings order increments [0]; rising demand in technical fields such as electronic warfare and radar [0]; spillover effect of global defense market expansion [6][7].

The limit-up event of Leike Defense reflects the short-term market enthusiasm and long-term growth potential of the military sector. Hot money participation is the direct trigger, but industry fundamentals (defense spending growth, technical demand) provide support. Investors need to pay attention to short-term fluctuation risks while focusing on the long-term development trend of the military industry.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.