Zhongji Innolight (300308.SZ) Market Cap Exceeds 600 Billion Yuan, Hitting a New High; AI Computing Power Demand Drives Optical Module Industry Boom to Surge

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Zhongji Innolight (300308.SZ), a leading Chinese high-end optical communication transceiver module enterprise, has recently performed brightly in the market. On November 26, 2025, it hit an intraday historical high of 556.88 yuan, closing at 543.22 yuan with a single-day increase of over 13%, and its total market cap exceeded 600 billion yuan [0][1][3]. The stock has a year-to-date cumulative increase of 339.82% and a cumulative increase of over 1909% since 2023, becoming one of the most watched hot stocks in the AI computing power concept [0].

- AI Computing Power Demand Explosion: The boom in AI data center construction has driven a surge in demand for optical modules; each NVIDIA GPU needs to be equipped with 6-8 optical modules [0][6]. Events such as Google’s AI computing power demand growth and Meta’s rental of Google TPU computing power have further boosted industry prosperity [0][1].

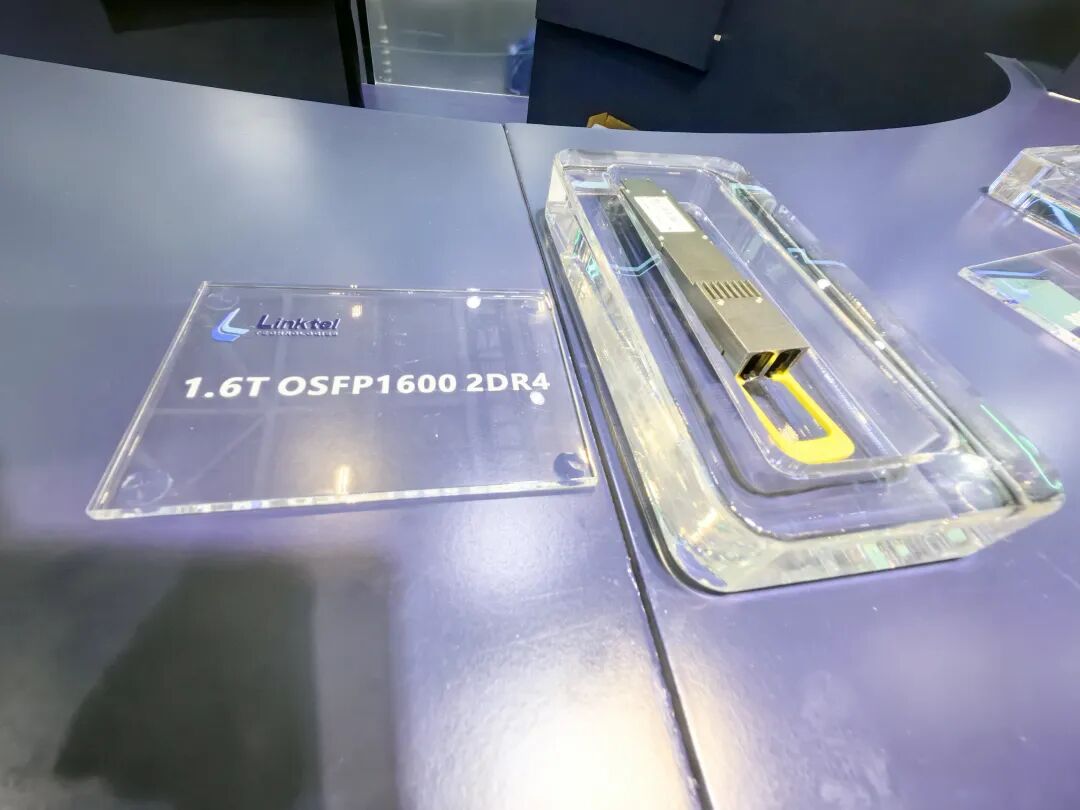

- Product Technological Advantages: The company focuses on 400G, 800G, and 1.6T high-speed optical module products; 1.6T products continue to gain volume, and 3.2T products are in the R&D stage [0].

- Capacity Expansion: The company actively expands high-end optical module capacity, transferring funds from the Suzhou project to the third phase of the Tongling Innolight High-end Optical Module Industrial Park project [0].

- Profit Growth: In the first half of 2025, net profit tripled, with the optical module business contributing significant revenue [0][5].

- Revenue & Production-Sales: In the first half of the year, the output of optical communication components increased by 38.38% year-on-year, sales volume increased by 15.80%, and operating income increased by 60.10% [0].

- Market Position: Its market cap surpassed Haier Smart Home, becoming the enterprise with the highest market cap in Shandong Province [0].

The optical module industry benefits from the continuous warming of the AI boom; CITIC Securities points out that the electronics industry has high prosperity, and optical modules are one of the key areas of focus [7]. Analysts predict that the industry’s net profit will hit a record high from 2025 to 2026, with an annual growth rate of at least 40% [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.