Tesla (TSLA) Stock Movement Analysis: Melius Upgrade Impact & Bearish Counterpoints on FSD and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 24, 2025, Tesla (TSLA) experienced a 7% intraday stock pop following Melius Research’s ‘must own’ upgrade citing Full Self-Driving (FSD) potential and Elon Musk’s AI chip progress [1]. The stock closed at $417.78, representing a 3.88% daily gain—outperforming its Consumer Cyclical sector which declined by 0.16% that day [0][6]. This movement reversed three consecutive days of losses, though volume (96.81M shares) was lower than prior sessions [0].

Bullish sentiment from the upgrade contrasts with retail investor skepticism on Reddit, where users raised concerns about FSD overhype relative to Waymo (Alphabet’s subsidiary), which operates fully driverless services in five U.S. cities [2][5]. Additional bearish points include unfulfilled product promises (Optimus robots, robotaxi deployment) and repetitive positive narratives [2].

- Intraday vs. Closing Disparity: The 7% intraday pop narrowing to a 3.88% close suggests profit-taking, indicating short-term sentiment may not translate to sustained gains [0].

- Valuation vs. Narrative: Tesla’s extreme P/E ratio (257x) [3] contrasts with the bullish narrative of long-term FSD value, highlighting a potential disconnect between valuation and fundamentals.

- Competitive Gap: Waymo’s lead in fully driverless deployment raises questions about Tesla’s FSD commercial viability, a critical factor in Melius’ upgrade [5].

- Valuation Risk: The 257x P/E ratio signals potential overvaluation, making the stock vulnerable to market corrections [3].

- FSD Competition: Waymo’s advanced deployment could erode Tesla’s autonomy leadership claim [5].

- Execution Risk: Unfulfilled promises (Optimus, robotaxis) may damage investor trust over time [2].

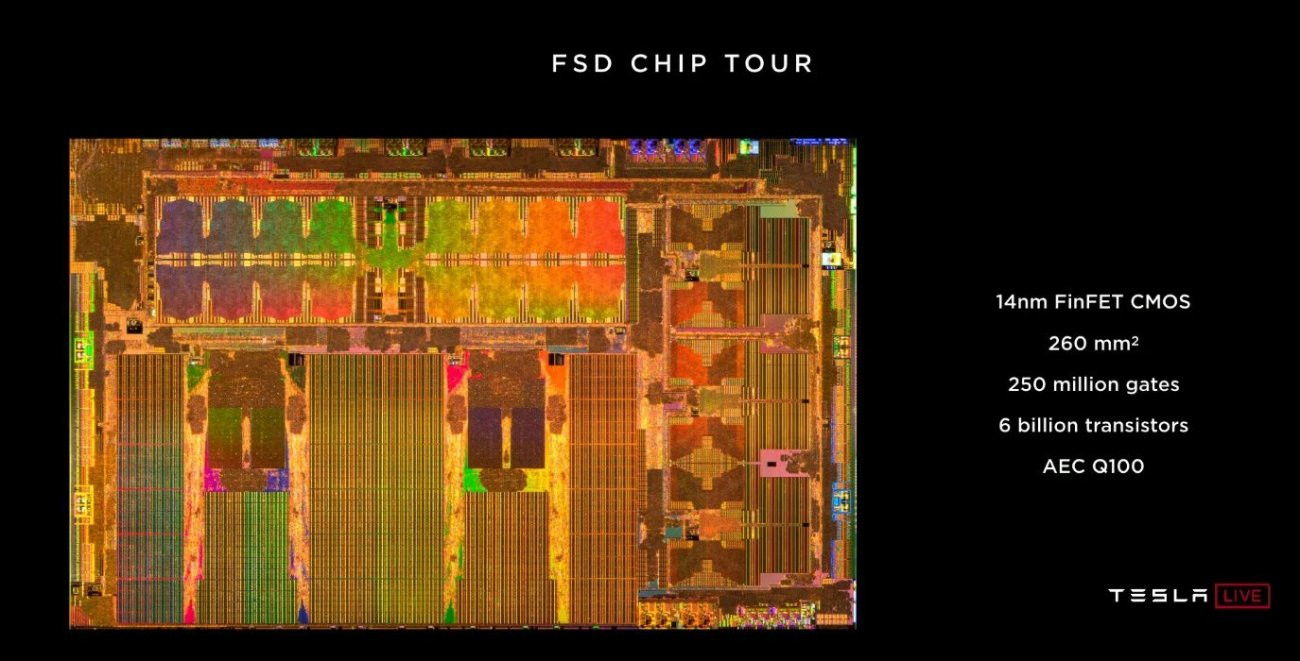

- AI Chip Progress: Musk’s comments on AI chip development highlight Tesla’s potential in the broader AI ecosystem [1].

- Institutional Confidence: Melius’ upgrade indicates ongoing institutional belief in Tesla’s long-term prospects [1].

Tesla’s November 24 stock movement reflects a mix of bullish institutional sentiment (Melius upgrade) and bearish retail concerns (FSD competition, unfulfilled promises). Key data points include:

- Intraday pop:7% | Daily close gain:3.88% [0][1]

- Consumer Cyclical sector decline:0.16% [6]

- Tesla’s P/E ratio:257x [3]

- Waymo’s fully driverless cities:5 [5]

This analysis provides objective context for decision-making without prescribing investment actions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.