GOOG After-Hours Rally on Meta TPU Talks: Competitive Dynamics & Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

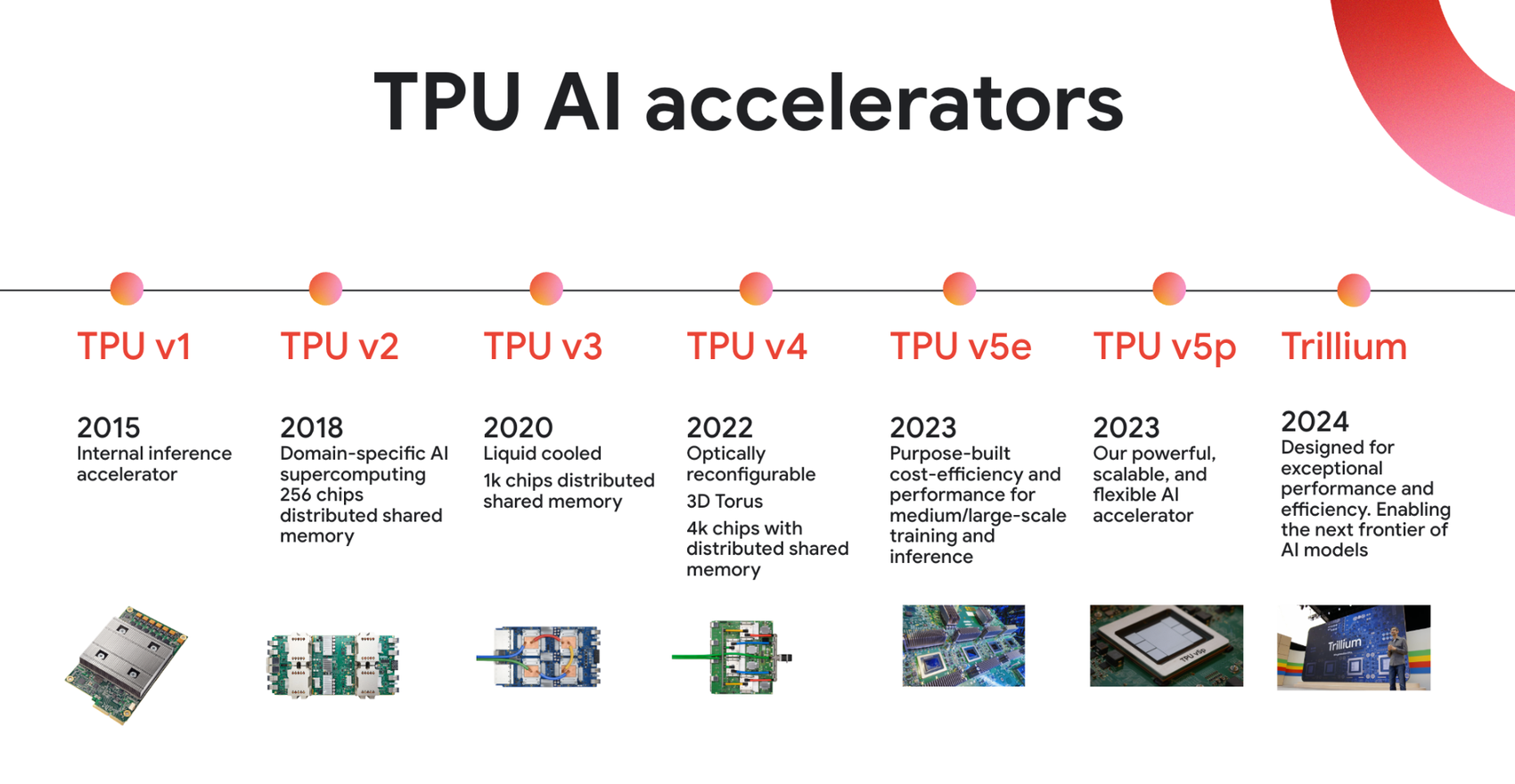

Alphabet Inc. (GOOG) saw after-hours gains (~2% per Reddit reports) on November 24, 2025, following news Meta Platforms (META) is in advanced talks to deploy Google’s Tensor Processing Units (TPUs) starting 2027 [1][3]. This marks Google’s entry into the third-party AI chip market, historically exclusive to its own infrastructure [1]. GOOG closed at $318.47 on Nov24 (up 2.4% intraday) and has rallied 29.9% over two months (Sept15-Nov24) [0]. NVIDIA (NVDA) shares fell ~2.6% on Nov25 due to competitive concerns [2], though its market cap ($4.39T as of Nov27) remains higher than GOOG ($3.87T), making the Reddit claim of GOOG surpassing NVDA by year-end unlikely [0]. Meta’s potential TPU adoption could yield long-term cost savings, but no immediate EPS impact data is available [3].

- Google’s Strategic Shift: Entering third-party AI chip sales opens a new revenue stream for GOOG, strengthening its AI ecosystem [1].

- NVDA’s Competitive Moat: Despite competition, NVDA retains leadership via its CUDA software stack and broad customer base, per Wedbush analyst Dan Ives [1].

- Meta’s Long-Term Benefits: TPU adoption could reduce Meta’s reliance on NVDA chips, but the 2027 timeline delays financial gains [1].

- FOMO Risk: Reddit users mention FOMO to buy GOOG, but the stock’s rally already prices in significant AI growth expectations [3].

- Deal Execution: Meta-Google talks are ongoing; failure to finalize terms would reverse GOOG’s positive sentiment [2].

- Competition for NVDA: Google’s TPUs pose a long-term threat to NVDA’s data center chip dominance [1].

- GOOG’s New Revenue: Third-party TPU sales could drive future growth for GOOG [1].

- Meta’s Cost Savings: Long-term adoption of TPUs may lower Meta’s operational costs [3].

- GOOG’s 2-month rally (Sept15-Nov24): +29.9% [0]

- NVDA’s market cap (Nov27): $4.39T vs GOOG’s $3.87T [0]

- NVDA’s Nov25 price drop: ~2.6% [2]

- Meta’s TPU adoption timeline: Potential start in 2027 [1]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.