Tesla Stock Pop Analysis: Melius 'Must Own' Call vs. Bearish Reddit Counterarguments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

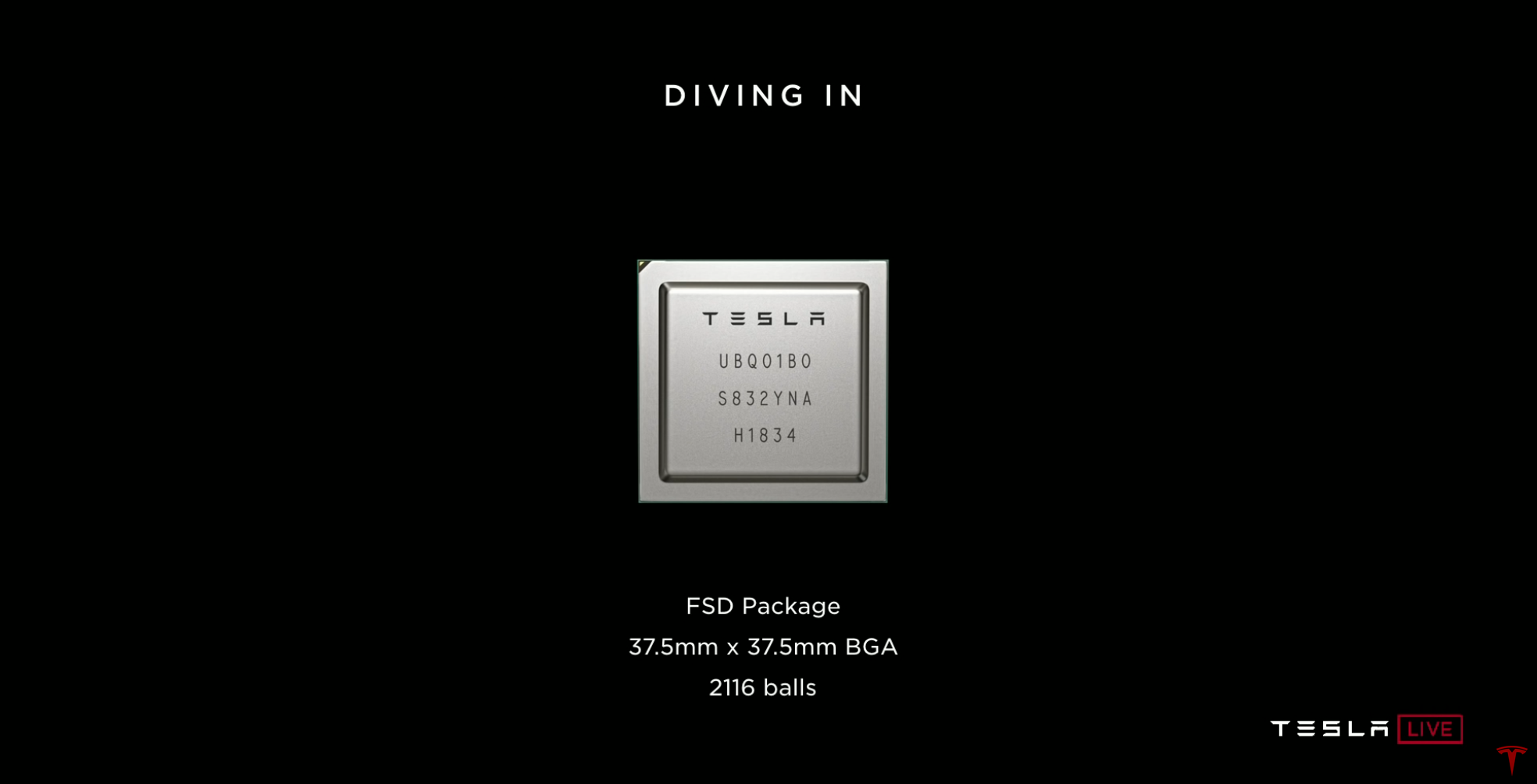

On November24,2025, Tesla (TSLA) experienced an intraday 7% pop (high $421.72) driven by Melius Research’s ‘must own’ call (FSD progress/AI chips) before closing at $417.78 (+3.88% daily gain) [0]. This followed Yahoo News coverage of the analyst call and Musk’s AI chip comments [2]. However, Reddit users countered with bearish arguments: FSD is overhyped (Waymo’s Level4 autonomy vs Tesla’s Level2) [1], declining financials (Q3 earnings down37% YoY) [2], repetitive positive narratives, and a 7% pop being ‘sus’ amid reputation/sales issues [0]. Over 5 days (Nov20-25), TSLA gained +6.03% [0].

Cross-domain correlations: Tesla’s high valuation (259x P/E) [5] is tied to investor expectations of FSD/AI chip success, but execution delays (Optimus mass production pushed to2027) [3] and regulatory risks [4] could erode this premium. The gap between bullish analyst calls and bearish retail sentiment highlights market uncertainty about long-term growth.

- Stock Performance: Nov24 intraday 7% pop, +3.88% close, 5-day +6.03% [0].

- Financials: Q3 earnings down37% YoY, P/E=259x, net margin=5.55% [2,5].

- Autonomy: Waymo (Level4, 2500+ fleet) vs Tesla (Level2, requires human backup) [1].

- Execution: Optimus pilot production (5k units 2025) [3], Robotaxi delays [3].

- Risks/Opportunities: Legal probes, EU FSD approval, AI chip monetization.

This analysis is for informational purposes only—no investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.