US Indices Gain Streak & Apple's Projected Smartphone Leadership: Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

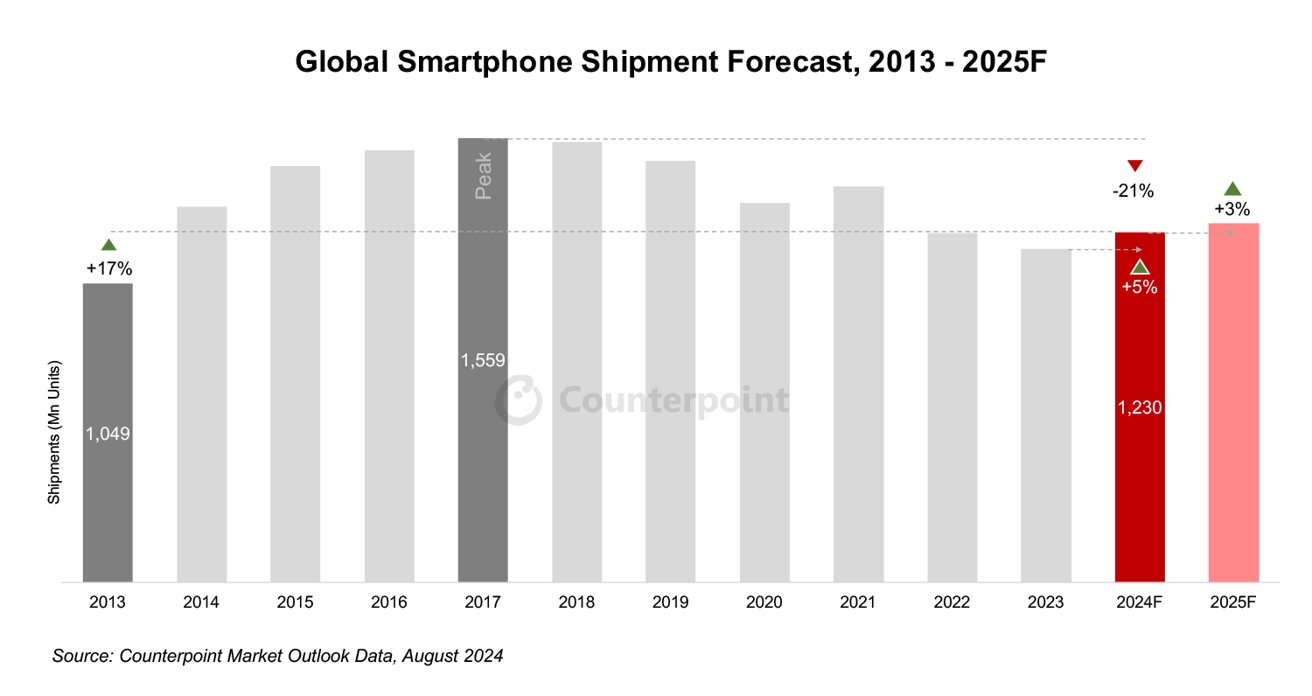

Major US indices (S&P500, NASDAQ, Dow Jones) closed higher for the fourth consecutive day on Nov26,2025, with cumulative gains of +1.53%, +1.50%, and +1.68% over three trading days (Nov24-26) [0]. This upward trend was supported by market expectations of an 85% chance of a Federal Reserve rate cut in December [1]. Counterpoint Research’s projection that Apple will ship 243 million smartphones in 2025—surpassing Samsung’s 235 million—marks Apple’s first global leadership in 14 years [1]. Apple (AAPL) stock closed at $277.55 on Nov26, up 0.59% over three days, though trading volume decreased sequentially (65.59M →46.91M →33.43M) [0]. Sector performance showed Energy leading gains (+1.77%) while the Tech sector posted a modest +0.15% increase [0].

- Cross-Sector Divergence: The Tech sector’s limited gain (+0.15%) despite positive Apple news suggests mixed sentiment in the broader tech space, possibly due to lingering concerns about global demand [0].

- Volume Trends: Decreasing AAPL trading volume indicates reduced buying interest, even as the company’s shipment projection made headlines [0].

- Rate Cut Dependency: Market gains are heavily tied to Fed rate cut expectations; any deviation from this narrative could trigger volatility [1].

- Fed Rate Cut Disappointment: The 85% probability of a December rate cut creates downside risk if the Fed holds rates steady [1].

- Projection Reliability: Apple’s shipment leadership is based on a single analyst firm (Counterpoint Research); investors should confirm with additional sources to mitigate forecast risk [1].

- Sector Underperformance: Tech’s modest gain (+0.15%) signals potential headwinds for the sector despite Apple’s positive outlook [0].

- Apple’s Market Share Gain: If Apple sustains its shipment leadership, it could strengthen pricing power and drive revenue growth in the smartphone segment [1].

- Energy Sector Momentum: The Energy sector’s strong performance (+1.77%) may present opportunities for investors focused on commodity-linked stocks [0].

- Market Indices: S&P500 (+0.28% Nov26), NASDAQ (+0.22% Nov26), Dow Jones (+0.49% Nov26) [0].

- Apple Performance: AAPL closed at $277.55 (Nov26) with a 0.59% three-day gain; volume decreased to 33.43M [0].

- Shipment Projections: Apple (243M) vs Samsung (235M) for 2025 [1].

- Sector Highlights: Energy (+1.77%), Tech (+0.15%), Consumer Cyclical (-0.07%) [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.