QIMC Natural Hydrogen Catalysts Analysis: Market Impact and Risk Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Quebec Innovative Materials Corp. (QIMC) gained attention on Reddit [1] for two key catalysts:

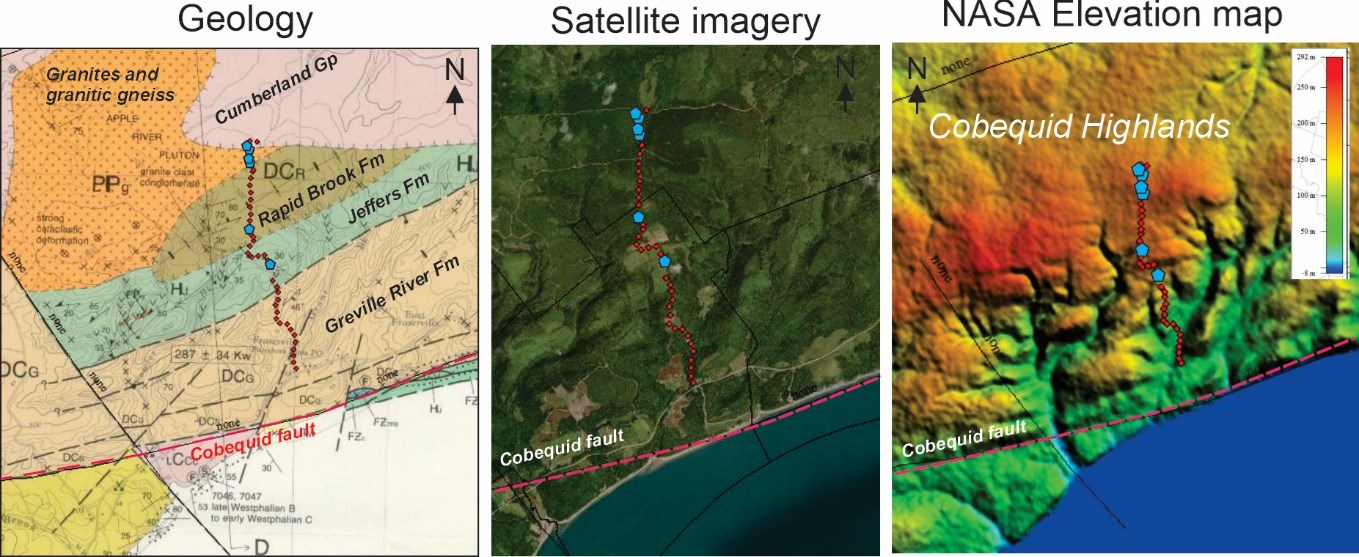

- A staking rush in Nova Scotia where billionaire-backed Koloma (Gates/Bezos-supported) staked adjacent land [1][2].

- U.S. expansion via Minnesota Renewable Gas Resource Areas (RGRAs) for natural hydrogen exploration [3].

QIMC positions as a first-mover in natural (white) hydrogen with proprietary methods, offering high-risk, high-reward potential tied to upcoming drills [1].

QIMC’s stock (CSE: QIMC) rose

Upcoming Nova Scotia winter drills (post-2025-11-24) are critical—success could validate QIMC’s model, failure may trigger corrections [3].

| Metric | Value | Source |

|---|---|---|

| Tickers | CSE: QIMC, US: QIMCF | [4] |

| Current Price | 0.54 CAD (8% daily gain) | [3] |

| Market Cap | ~67.88M CAD | [3] |

| Volume | 2.04M shares (above avg) | [3] |

| Catalyst Dates | Nova Scotia drills (2025-11-24), Minnesota RGRAs (2025-11-26) | [3] |

- Direct: QIMC (CSE: QIMC, US: QIMCF)

- Related: QMET (CSE: QMET, adjacent Nova Scotia projects) [2]

- Sector: Natural hydrogen exploration (speculative clean energy)

- Koloma’s exact staking details relative to QIMC [2].

- QIMC’s financial health (revenue, cash burn, dilution history) [3].

- Drill result timeline [3].

- Nova Scotia drill results (Q4 2025/Q1 2026 expected) [3].

- Minnesota regulatory progress [3].

- Koloma’s exploration activities [2].

- Dilution:Share count increased from ~75M to ~140M in 1.5 years [3].

- Speculative Sector:Natural hydrogen has unproven commercial viability [3].

- Volatility:Penny stock with extreme price swing potential [3].

- Competition:Koloma (well-funded adjacent competitor) [2].

[1] Reddit (r/pennystocks): “QIMC Just Dropped Two HUGE Catalysts…” URL: https://www.reddit.com/r/pennystocks/comments/

[2] Reddit (r/pennystocks): “Natural Hydrogen in Nova Scotia…” URL: https://www.reddit.com/r/pennystocks/comments/1p8le0e/

[3] CEO.CA: “QIMC.CN Real-Time Data & News” URL: https://pro.ceo.ca/qimc

[4] Stockhouse: “QIMC Bullboard” URL: https://stockhouse.com/companies/bullboard?symbol=c.qimc

Disclaimer: This is informational, not investment advice. Conduct independent research.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.