Industry Analysis Report: AI-Driven Memory Shortage & Capitalization Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 25, 2025 (EST), a Reddit user asked about capitalizing on the AI-driven memory shortage, seeking “safe” companies for long-term investment (10+ years). The discussion highlighted:

- Established memory producers(Samsung, SK Hynix, Micron) as preferred long-term bets due to scale, infrastructure, and customer base.

- Equipment suppliers(ASML, Applied Materials) as indirect beneficiaries of new fab builds.

- Cyclicality concerns: High memory prices are temporary, with the market prone to boom-bust cycles.

- Cartel-like behavior: A low-confidence claim that top producers fix prices to maintain profits.

The analysis below leverages sector data, company overviews, and recent market reports to validate these claims and assess industry impact.

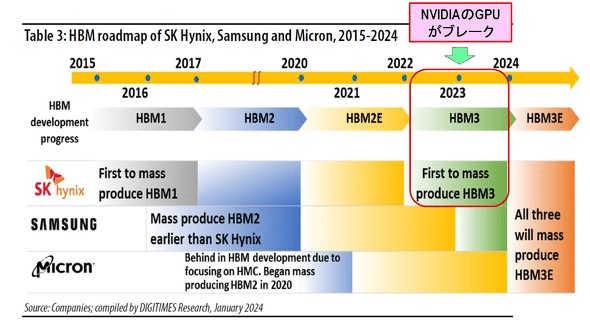

AI workloads (large language models, generative AI) are driving unprecedented demand for high-bandwidth memory (HBM) and data center storage. Macquarie notes AI demand is “far from a bubble” with ongoing shortages in AI chips and high-end memory [6]. Micron’s data center SSD business reached record revenue and market share in FY2025, with expectations of continued growth into 2026 [6].

Memory prices have surged

While short-term prices are elevated, the memory market remains cyclical. The Reddit claim of temporary high prices aligns with historical trends: supply expansions (e.g., Samsung’s new South Korea fab, SK Hynix’s capacity increases) will eventually ease shortages and stabilize prices [7].

Recent search results (2025) do not show active price-fixing allegations against Samsung, SK Hynix, or Micron. Micron faced a class action lawsuit in early 2025, but it centered on misleading investors about consumer demand—not price collusion [8]. The cartel claim from Reddit lacks recent evidence.

The memory market remains concentrated among three key producers:

- Micron (MU): 170% YTD gain, 79% analyst buy ratings, and a $325 price target from Morgan Stanley (up from $220) [1,6]. Its DRAM products account for 77% of revenue, with strong exposure to AI data centers [1].

- Samsung: While direct data is unavailable (SSNGY symbol error), it is expanding production (new South Korea fab) to meet AI demand [7].

- SK Hynix: Similarly, direct data is unavailable (HXSCL symbol error), but it reported record quarterly performance in 2025 driven by DRAM/NAND price hikes [7].

- ASML (ASML): 51% YTD gain, 34.8% operating margin, and dominance in EUV lithography (critical for advanced memory production) [2].

- Applied Materials (AMAT):53% YTD gain,24.67% net profit margin, with 73.7% of revenue from semiconductor systems [3].

These suppliers benefit from fab expansions by memory producers, creating a moat due to high technical barriers to entry.

The landscape has high entry barriers: fab construction costs exceed $10B, and technical expertise in advanced memory (HBM3E, HBM4) is limited. No significant new players are expected in the next 3–5 years.

- Micron’s AI Leadership: Morgan Stanley labels Micron a “top pick” as the shortage drives earnings upside, with the stock yet to fully price in AI demand [6].

- ASML’s EUV Demand: The company’s EUV systems are sold out through 2027, driven by memory and logic chip producers [2].

- Consumer Price Pass-Through: Smartphone and PC prices are expected to rise in 2026 as manufacturers pass memory costs to consumers [7].

- Fab Expansions: Samsung’s new South Korea fab and SK Hynix’s capacity increases will add supply by 2027, easing shortages [7].

- Long-term: Prioritize established producers (Micron, Samsung, SK Hynix) and equipment suppliers (ASML, AMAT) for stable returns. Micron’s 170% YTD gain and ASML’s 51% YTD gain reflect this trend [1,2].

- Short-term: Avoid speculative plays (e.g., MU calls) due to cyclicality risks.

- Plan for sustained high memory costs through 2026; consider product mix shifts to higher-margin AI-enabled devices (e.g., Dell’s AI PC push) [6].

- Equipment makers (ASML, AMAT) should ramp production to meet fab expansion demand; upstream material suppliers (e.g., rare earths, silicon wafers) will see increased orders.

- Monitor supply chain concentration (three producers dominate) to ensure market stability; address trade tensions (e.g., US-China tech restrictions) that could disrupt memory supply.

- AI Demand Trajectory: Sustained growth in AI workloads will extend the shortage; a slowdown in AI investment would trigger a price correction.

- Supply Expansion Speed: Samsung/SK Hynix/Micron’s fab build timelines will determine when shortages ease.

- Regulatory Risks: Trade restrictions (e.g., export controls on EUV systems to China) could disrupt production for some players.

- Technological Innovation: Advancements in HBM (e.g., HBM4) will create competitive advantages for producers with early adoption (e.g., Micron’s HBM3E rollout).

[1] Company Overview: Micron Technology (MU)

[2] Company Overview: ASML Holding (ASML)

[3] Company Overview: Applied Materials (AMAT)

[6] Web Search: “AI-driven memory shortage 2025 demand outlook”

[7] Web Search: “Memory market cyclical trends 2025 semiconductor industry”

[8] Web Search: “Samsung SK Hynix Micron cartel-like behavior price fixing allegations 2025”

Note: Direct data for Samsung (SSNGY) and SK Hynix (HXSCL) was unavailable due to symbol errors.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.