GOOG After-Hours Rally & Meta TPU Speculation: Market Impact & Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

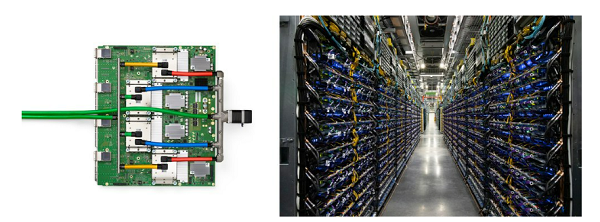

The event stems from a Reddit post [1] claiming Alphabet Inc. (GOOG) shares rose to $327 in after-hours trading on November 24, 2025, due to reports Meta Platforms (META) is considering deploying Google’s AI chips (TPUs) in its data centers instead of NVIDIA’s (NVDA) GPUs. Internal data [0] confirms GOOG has gained 67.81% from August 1 to November 24, 2025, with an after-hours price of $320.12 (slight decline from the Reddit claim). NVDA’s after-hours price dropped by -2.08% to $176.51, while META gained +2.26% to $647.95. Market caps as of November 24 are GOOG ($3.86T), NVDA ($4.30T), and META ($1.63T), meaning GOOG needs to gain ~11.3% to surpass NVDA (contradicting the Reddit claim of year-end dominance [1]).

- AI Chip Ecosystem Shift: If Meta uses Google’s TPUs, it could challenge NVDA’s dominance in the AI chip market, though this claim is unsubstantiated [1].

- GOOG’s Momentum: GOOG’s 67.81% gain in ~4 months reflects strong investor confidence in its AI initiatives (e.g., Gemini 3), but validation of TPU adoption is critical.

- Speculative Market Reaction: NVDA’s drop and META’s gain highlight investor sensitivity to cost-saving opportunities and competitive threats from AI chip alternatives.

- Unverified Source: The Reddit post is a Tier4 user-generated content [1], leading to speculative investment decisions.

- FOMO Risk: Reddit users mentioned FOMO-driven buying [1], which may result in overpaying for shares based on unconfirmed news.

- NVDA Revenue Risk: If Meta switches to Google’s TPUs (unconfirmed), NVDA could lose a major customer, impacting revenue.

- GOOG TPU Expansion: Google could expand TPU adoption beyond its ecosystem, boosting its AI chip business.

- Meta Cost Savings: META may reduce AI infrastructure costs if using Google’s TPUs, improving margins.

- GOOG Momentum: Continued validation of AI initiatives (like TPUs) could sustain GOOG’s rally.

- GOOG Performance: 67.81% gain from August 1 to November 24, 2025 [0].

- After-Hours Prices: GOOG ($320.12), NVDA ($176.51), META ($647.95) [0].

- Market Caps: GOOG ($3.86T), NVDA ($4.30T), META ($1.63T) [0].

- Unverified Claim: No credible sources (e.g., Bloomberg, Reuters) have confirmed Meta’s TPU deployment [2].

- Actionable Steps: Wait for official statements from Meta/Google; monitor earnings calls for AI infrastructure updates.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.