QIMC Natural Hydrogen Catalysts: Nova Scotia Staking & Minnesota Permits Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

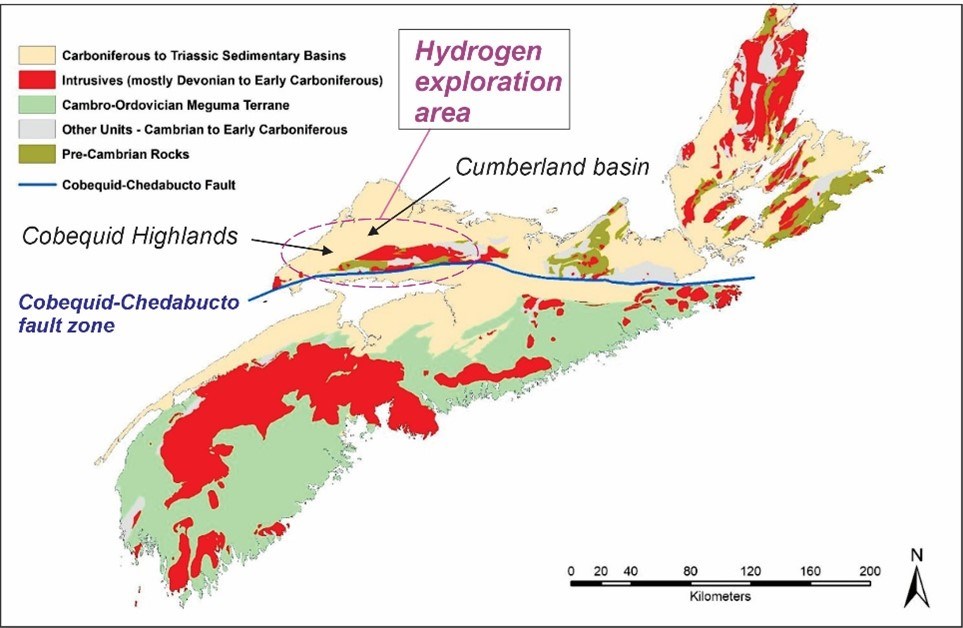

QIMC, a natural hydrogen (white hydrogen) explorer, recently revealed two critical developments: a Nova Scotia staking rush (purportedly with billionaire-backed Koloma adjacent) and U.S. expansion via Minnesota Resource Exploration and Development Agreements (RGRAs) [1][3]. These align with its first-mover positioning in a nascent clean energy sector using proprietary geological methods [1].

Market data shows QIMC closed at CAD 0.54 on Nov 28, 2025 (8% daily gain, 575% YTD) with a ~CAD 67.88M market cap [2][5]. Financials reflect early-stage status: no revenue, negative EPS (-0.03 CAD), and a 146.08 price-to-book ratio (significant premium) [2][5].

Nova Scotia staking is cited as validation, but Koloma’s adjacent claims/Gates/Bezos connection lack independent confirmation [1][0]. Minnesota RGRAs mark U.S. entry, though their specific implications for hydrogen exploration are unclear [3][0].

- Sector Niche: Natural hydrogen is a growing clean energy niche, with QIMC leveraging proprietary methods to capture early interest [0].

- Speculative Valuation: High YTD gains and P/B ratio indicate market optimism not supported by current financial performance [2][5].

- First-Mover Potential: Early exploration efforts could yield competitive advantages if the sector matures, though unproven [1][0].

- Uncertainty Gaps: Lack of confirmed Koloma details and drill timelines create decision-making ambiguity [0].

- Speculative Sector: Natural hydrogen has no proven commercial production at scale [0].

- Financial Viability: Negative earnings and no revenue raise long-term funding concerns [2][5].

- Exploration Risks: Nova Scotia drill results may not confirm commercial hydrogen quantities [1][0].

- Regulatory Uncertainty: Evolving natural hydrogen regulations in Canada/U.S. could impact plans [0].

- Volatility: Small-cap status makes QIMC prone to extreme price swings [2][5].

- Clean Energy Demand: Global low-carbon energy trends could drive interest in natural hydrogen [0].

- U.S. Expansion: Minnesota RGRAs provide access to a key clean energy market [3][0].

- First-Mover Edge: Proprietary methods may position QIMC ahead of competitors if the sector scales [1][0].

QIMC’s recent catalysts include Nova Scotia staking and Minnesota RGRAs for natural hydrogen exploration [1][3]. Critical data points:

- Price: CAD 0.54 (Nov 28, 2025)

- Market Cap: ~CAD 67.88M

- Financials: No revenue, EPS -0.03 CAD

- Key Gaps: Unconfirmed Koloma details, drill timelines, regulatory clarity, funding plans [0][1][2]

This summary provides objective context without prescriptive recommendations [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.