QIMC Natural Hydrogen Catalysts Analysis: Nova Scotia Drilling & Minnesota Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

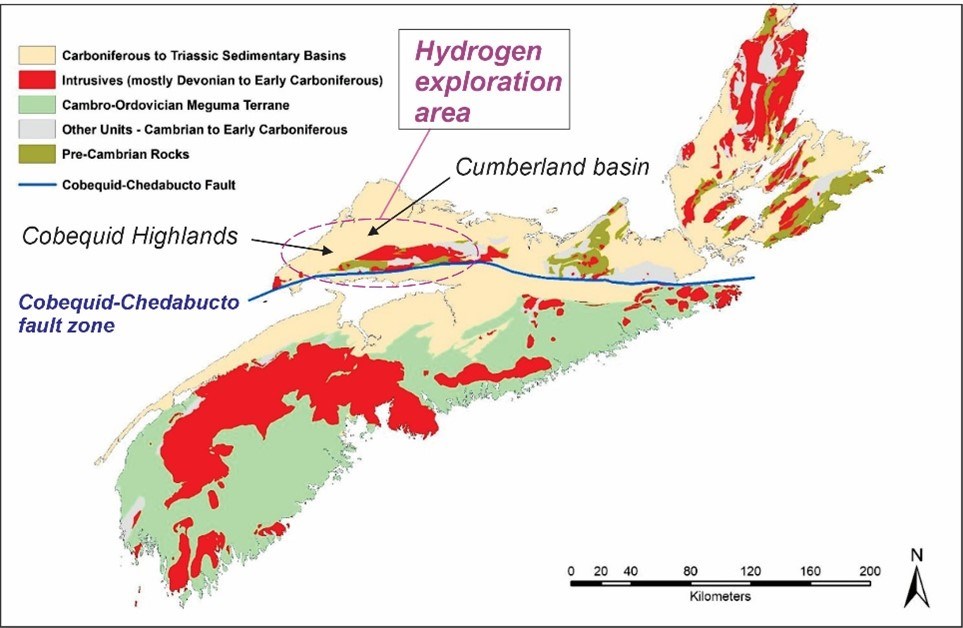

This analysis is based on a Reddit post [1] published on November 26, 2025, highlighting two key catalysts for Quebec Innovative Materials Corp. (QIMC). QIMC is a resource exploration firm focused on natural (white) hydrogen and silica deposits across North America [2]. The first catalyst is a staking rush in Nova Scotia’s Cobequid Fault region, where QIMC plans winter drilling following soil-gas samples showing hydrogen concentrations up to 5,558 ppm [5]. The second catalyst is U.S. expansion via Orvian (QIMC’s SPV), which was awarded two Resource Exploration and Development Agreements (RGRAs) in Minnesota [4]. While the Reddit post speculates that billionaire-backed Koloma (Gates/Bezos connections) is staking adjacent claims in Nova Scotia [1], this has not been publicly confirmed [0]. Koloma’s $245.7M funding in 2024 (backed by Breakthrough Energy Ventures) validates institutional interest in the natural hydrogen sector [3]. Key data gaps include unclear trading tickers (errors for QIMCF and QIMC.CN [0]), lack of financial metrics [0], and no exact timeline for drilling results [5].

Cross-domain connections include the intersection of clean energy (natural hydrogen as a carbon-free fuel) and resource exploration. QIMC’s first-mover position in this nascent sector presents upside (potential institutional investment if drilling succeeds) and downside (high speculation due to unproven commercial viability). The Reddit post’s credibility issues (low-quality presentation [1]) highlight the need for verifying user-generated content against official sources. Regulatory gaps in the natural hydrogen sector could impact QIMC’s operations, as there are no established rules for this emerging subsector [0].

- Speculative Nature: Natural hydrogen exploration is high-risk with no guarantee of commercial success [2].

- Geological Uncertainties: Drill results may not confirm economically viable deposits [5].

- Financing Risks: QIMC may need additional capital, potentially diluting shareholder value [0].

- Regulatory Risks: Unclear regulations could delay projects [0].

- Credibility Concerns: Reddit post’s presentation quality raises questions about information reliability [1].

- Sector Growth: Natural hydrogen’s potential as a clean energy source could drive long-term demand [3].

- First-Mover Advantage: QIMC’s early entry may attract institutional interest if results are positive [0].

- North American Expansion: Minnesota RGRAs provide access to new markets [4].

QIMC’s recent catalysts (Nova Scotia drilling, Minnesota permits) position it as a player in the emerging natural hydrogen sector. However, significant data gaps (ticker clarification, Koloma staking confirmation, financial metrics) and high speculative risks require further due diligence. The sector’s growth potential is balanced by geological and regulatory uncertainties, making QIMC a high-risk/high-reward opportunity. No investment recommendations are provided; users should conduct thorough research before making decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.