QIMC Catalysts Analysis: Nova Scotia Staking and Minnesota Permits in Natural Hydrogen Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

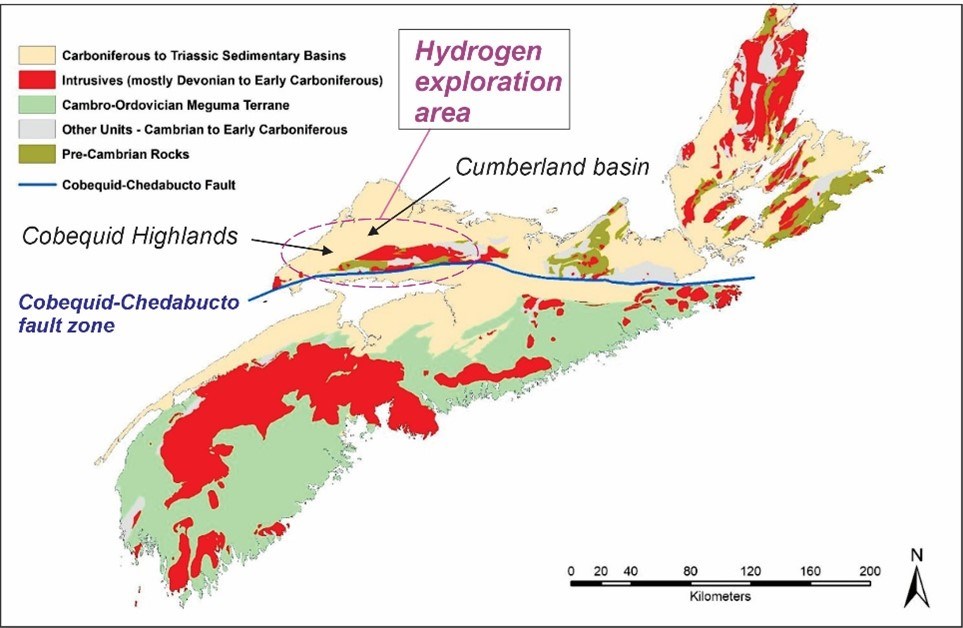

QIMC, a natural hydrogen (white hydrogen) company, is highlighted in a Reddit post for two catalysts: a claimed Nova Scotia staking rush (with unconfirmed Koloma adjacent participation [1]) and Minnesota RGRAs awarded to its SPV Orvian [2]. Koloma’s backing by Gates’ Breakthrough Energy Ventures and Amazon [3] adds sector credibility, though QIMC’s staking claim remains unproven. Financial data shows QIMC.CN has ~67.88M CAD market cap and -0.03 TTM EPS [4], indicating unprofitability. The company is a first-mover in the nascent clean energy sector, but viability depends on unconfirmed Nova Scotia drill results.

Cross-domain insights: Institutional interest in natural hydrogen (Koloma’s $245.7M funding [3]) contrasts with QIMC’s unconfirmed claims [1] and limited details on RGRAs [2]. The high-risk, high-reward dynamic is underscored by the speculative sector and unprofitable operations [4].

QIMC’s catalysts include claimed Nova Scotia staking (unconfirmed) and Minnesota RGRAs [1, 2]. Financials: ~67.88M CAD market cap, -0.03 EPS [4]. Investors should verify claims and review financials to assess risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.