Weekly Market Recap (Nov17-21,2025): Nvidia Earnings Reaction, Rate Cut Hopes, and Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

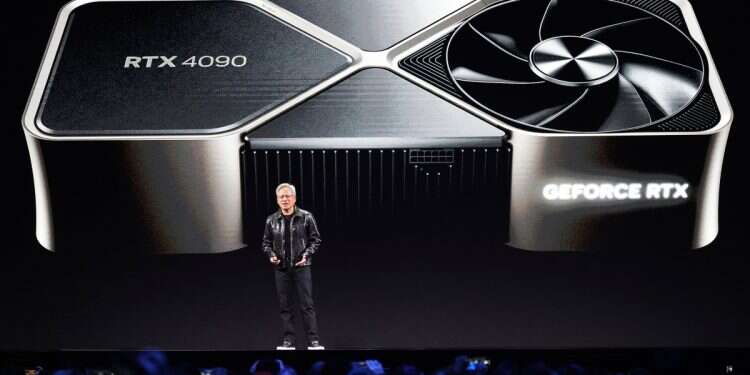

The week of Nov17-21,2025, was marked by mixed market signals. Nvidia (NVDA) reported record Q3 revenue ($35.1B, +94% YoY) [1] but its stock dropped 7.81% on earnings day (Nov20) due to AI spending sustainability and valuation concerns [3,10]. The S&P500 fell1.95% for the week [8], with a -2.96% single-day loss on Nov20 driven by tech sector worries [2]. However, rate cut hopes lifted the index by +0.72% on Nov21 as Dec Fed rate cut odds surged to85% post-PPI [2,7]. Buffett’s Berkshire Hathaway’s purchase of Alphabet stock was confirmed [5], though the $4.9B stake amount remains unsubstantiated [9]. Trump’s tariff extensions on Chinese products were noted [6], but their sector-specific impacts need further analysis.

- Valuation vs. Earnings: Nvidia’s stock drop despite strong earnings underscores market concerns over overvaluation in tech stocks [3,10].

- Rate Cut Dependence: The market’s recovery on Nov21 highlights its sensitivity to Fed policy expectations—any reversal could trigger volatility [7].

- Unverified Claims: Concerns over a Venezuela conflict leading to Black Monday lack supporting data, warranting caution before acting [0].

- Valuation risk for tech stocks like NVDA [3,10].

- Market volatility tied to rate cut uncertainty [2,8].

- Unsubstantiated geopolitical risks (Venezuela conflict) [0].

- Nasdaq optimism driven by rate cut hopes [7].

- Berkshire’s Alphabet stake (if confirmed) may signal confidence in large-cap tech [5].

- NVDA’s weekly performance: -4.14% (Nov17-21) [3].

- S&P500’s weekly drop:1.95% [8].

- Dec Fed rate cut odds:85% [7].

- Info gaps: Verify Buffett’s $4.9B Alphabet stake [9], analyze tariff sector impacts [6], and assess Venezuela conflict claims [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.