NVIDIA (NVDA) Stock Analysis Amid Google TPU Competition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

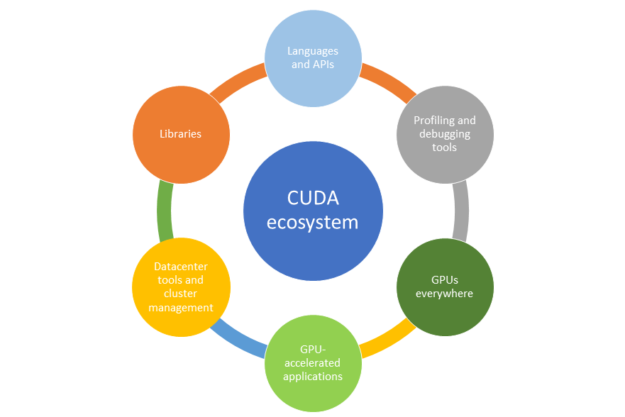

On 2025-11-28 (07:33 EST), a Reddit discussion analyzed whether NVIDIA is a buy amid Google TPU competition. Key arguments: bullish (CUDA ecosystem lock-in, Blackwell/Rubin cost-effectiveness), bearish (PE ~43x overvaluation, margin compression risk), neutral (TPU power efficiency, AMD alternative) [Event Content].

- Short-term: NVDA down 2.08% (1-day) and 13% (1-month) as of 2025-12-01. Meta’s TPU deal news caused a ~4% dip, erasing ~$250B in market value [1].

- Medium-term: Analyst consensus target $250 (41.6% upside) [0].

- Sentiment: Cautious investor sentiment (13% monthly drop) vs 73.4% analyst buy ratings [0].

| Metric | Value | Source |

|---|---|---|

| PE Ratio (TTM) | ~43.29x | [0] |

| Net Profit Margin | ~53.01% | [0] |

| Market Cap | ~$4.3T | [0] |

| 1-Month Price Change | -13% | [0] |

| Analyst Target | $250 | [0] |

- Direct: NVDA [0]

- Related: Semiconductors, Google Cloud [1][3]

- Upstream/Downstream: Meta, Google, AI startups [1][2]

- NVDA revenue exposure to TPU-switching customers

- TPU adoption by other hyperscalers

- Real-world Blackwell/Rubin vs TPU cost-effectiveness

- Bullish: CUDA ecosystem lock-in [0][3]

- Bearish: TPU power efficiency (2x per watt) [2][4]

- Neutral: Data center revenue (88.3% of total) vulnerable, but gaming/automotive diversify [0]

- Margin compression risk from Meta’s TPU deal (53% → ~30%) [1][Event Content]

- Valuation risk (PE ~43x) [0]

- Meta’s TPU deal finalization [1]

- Blackwell/Rubin adoption [0]

- Google TPU sales growth [2]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.