NVIDIA (NVDA) Valuation & Competitive Position Analysis Amid Google TPU Competition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 28, 2025 (EST), a Reddit discussion evaluated NVIDIA’s investment case amid competition from Google’s Tensor Processing Units (TPUs). Key arguments included:

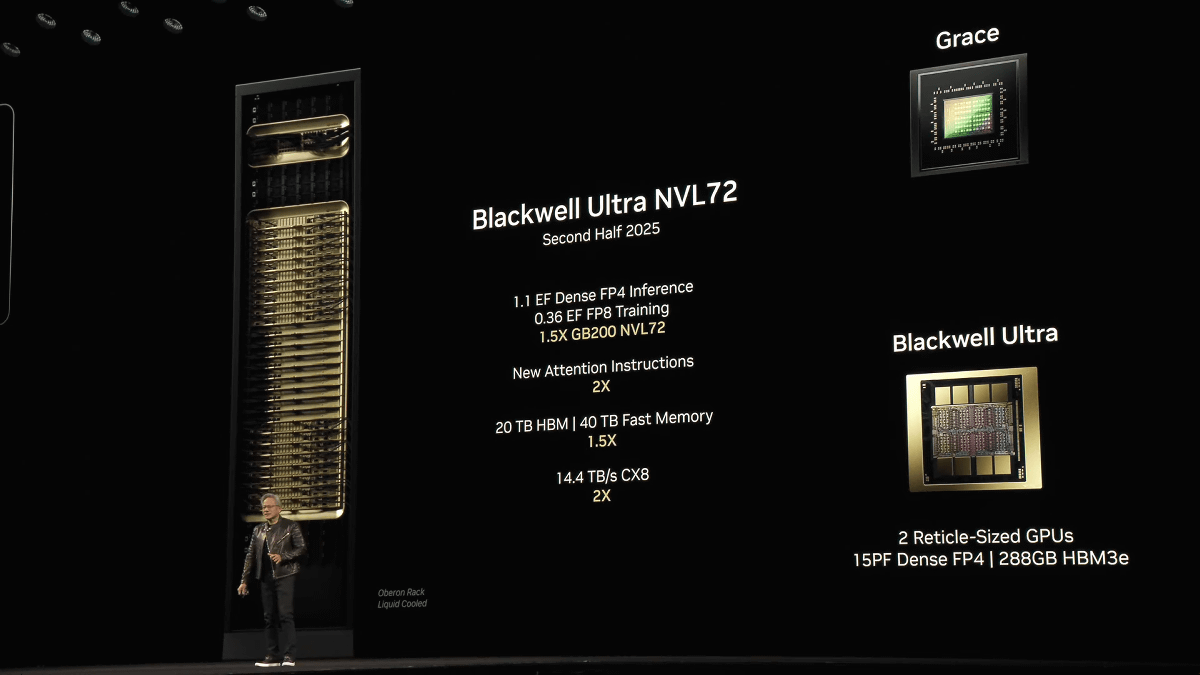

- Bullish: NVDA is undervalued due to its ecosystem lead; Blackwell/Rubin chips are cost-effective vs TPUs.

- Bearish: A ~50x P/E ratio is overvalued for a mature company; TPUs could reduce margins significantly.

The debate centered on whether NVDA remains a buy despite TPU competition.

NVDA’s stock performance reflects investor concerns about valuation and competition:

- Short-Term Trend: From October 28 to November 28, 2025, NVDA declined 8.31% (from $193.05 to $177.00) [0]. Over one month, it dropped 12.83% [0].

- Competitive Context: Web search results indicate TPUs are a “cost-effective hedge” (not replacement) for NVDA’s GPUs, driven by NVDA’s supply constraints [1]. Hyperscalers like Meta use TPUs to diversify, but this does not signal a shift away from NVDA [1].

- Long-Term Resilience: SemiAnalysis noted NVDA’s upcoming Rubin chips will counter TPU advantages, as TPUs have higher Model FLOP Utilization (MFU) but lag in peak performance [2].

- Valuation Metrics: NVDA’s current P/E ratio is ~43.69x (lower than Reddit’s 50x claim but still high for semiconductors) [0]. Its value score of 4.08/100 indicates overvaluation on traditional metrics [0].

- Profitability: NVDA’s net profit margin of 53.01% is exceptional [0], but competition from TPUs could pressure margins if adoption grows [2].

- Analyst Consensus: The average target price is $250 (+41.6% upside from $176.51) [0]. 73.4% of analysts rate NVDA as “Buy” [0].

- Volatility: Daily price standard deviation is 2.59% [0], reflecting high sensitivity to competitive news.

- Supply Chain: Unclear when Rubin chips will be widely available and if Blackwell supply constraints are easing.

- TPU Adoption: No data on the exact percentage of hyperscaler infrastructure using TPUs vs NVDA GPUs.

- AMD’s Position: Reddit mentioned AMD as an alternative, but recent market share data for AMD’s AI chips is missing.

- Growth Sustainability: Need to verify if NVDA’s data center revenue (88.3% of total) [0] will maintain current growth rates.

- Valuation Risk: NVDA’s ~43x P/E ratio is above industry averages. Users should be aware this may lead to a correction if growth slows [0].

- Margin Pressure: Competition from TPUs could reduce NVDA’s premium pricing power, impacting its 53% margin [0,2].

- Supply Chain: Persistent chip shortages may drive more hyperscalers to TPUs as a hedge [1].

- Competitive Landscape: Monitor Google’s TPU rollout and AMD’s market share gains in AI chips.

[0] Ginlix Analytical Database (tools: get_stock_realtime_quote, get_company_overview, get_stock_daily_prices)

[1] Benzinga, “Google TPUs Are ‘Cost-Effective Hedge,’ Not Replacement For Nvidia,” Nov 26,2025. URL: https://www.benzinga.com/markets/equities/25/11/49077878/google-tpus-are-cost-effective-hedge-not-replacement-for-nvidia-strategist-says

[2] SemiAnalysis, “Google TPUv7: The 900lb Gorilla In the Room,” 2025. URL: https://newsletter.semianalysis.com/p/tpuv7-google-takes-a-swing-at-the

[3] Futunn, "SemiAnalysis Provides In-Depth Analysis of TPU—Google,"2025. URL: https://news.futunn.com/en/post/65579252/semianalysis-provides-in-depth-analysis-of-tpu-google-googus-googlus

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.