CannGrong Technology (301148) Limit-Up Reasons and Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

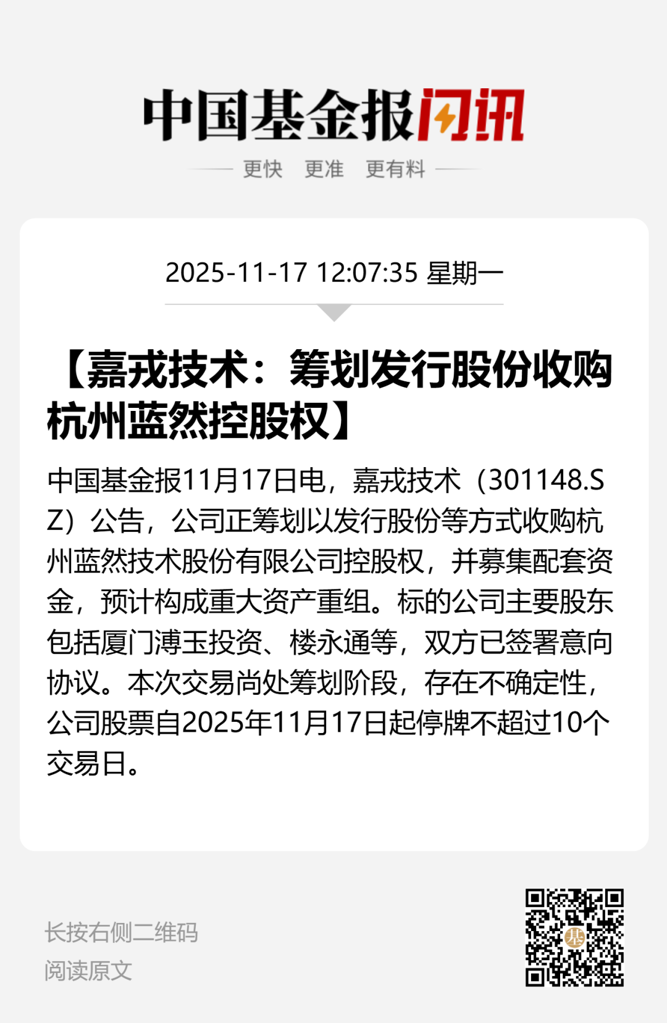

- Limit-Up Reasons: According to source information [1], CannGrong Technology (301148)’s limit-up this time is mainly driven by positive news of M&A and a change in actual controllers. The M&A target Hangzhou Lanran focuses on electrodialysis technology, which forms an industrial chain synergy with the company’s existing membrane separation business [0], helping with technical complementarity and market expansion, which is beneficial for the company’s long-term development.

- Market Performance: The company opened at the limit-up price on the same day, with a limit-up price of 39.64 yuan and a total market capitalization of 4.618 billion yuan [0]. The limit-up pattern (一字涨停) indicates scarce selling orders and high investor recognition of the positive news [0].

- Market Sentiment: The combination of M&A, change in actual controllers, and business synergy triggered a positive market reaction [0], with investors optimistic about the company’s strategic layout of improving the industrial chain through M&A.

- Business Synergy Value: The combination of electrodialysis technology and membrane separation business can form a more complete environmental water treatment technology solution, enhancing the company’s market competitiveness [0].

- Limit-Up Signal: The opening limit-up reflects strong market expectations for positive news, and the stock price may continue to perform strongly in the short term [0].

- Opportunities: If the M&A progresses successfully, it will bring technical and market expansion opportunities to the company, increasing long-term development space [0].

- Risks: Need to pay attention to the uncertainty of M&A progress, such as supporting fund issuance, performance fulfillment of the target company, and other factors [0].

- Technical Aspect: Need to pay attention to whether the stock price breaks through previous highs and changes in trading volume. If trading volume increases abnormally or the limit-up is broken, investors need to be vigilant of short-term fluctuation risks [0].

CannGrong Technology (301148) rose to the limit due to positive news of M&A, change in actual controllers, and business synergy, with positive market sentiment. Future development needs to focus on factors such as the progress of the M&A project, the target’s performance, and changes in market trading volume to evaluate the sustainability and stability of the stock price trend.

All analyses are based on public market information and business logic deductions, and do not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.