Gain Therapeutics (GANX) Phase 1b Trial Success & December Catalysts: Market Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

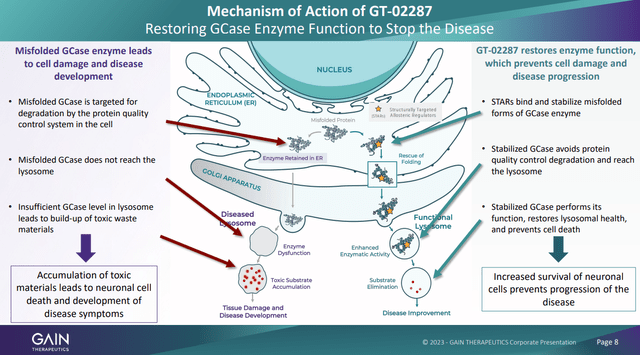

Gain Therapeutics (GANX), a clinical-stage biotech focused on neurodegenerative diseases, has generated bullish retail sentiment (Reddit, X) due to positive Phase 1b results for GT-02287—including reversal of smell loss (an early Parkinson’s symptom) and improved MDS-UPDRS motor scores [1][3]. Preclinical data presented at Neuroscience 2025 highlighted mitochondrial neuroprotection [4]. Recent market performance shows a 7.53% price increase to $3.14 with 1.93M shares traded (2x average volume) [0], supported by a Zacks upgrade to Buy [5]. The stock’s market cap ($113.34M) remains below peers in the Parkinson’s space, indicating potential undervaluation if catalysts deliver [3].

- Cross-Domain Alignment: Retail enthusiasm (Reddit/X) and analyst validation (Buy upgrade) signal growing confidence in GANX’s pipeline.

- Unmet Medical Need: Parkinson’s disease has limited treatment options, so positive trial results address a critical gap—potentially driving valuation re-rating.

- Catalyst-Driven Upside: December’s biomarker data, extended trial results, and IND submission could trigger significant price movement if positive.

- Catalyst Upside: Positive December data may lead to 5-10x returns as cited by retail investors [1].

- Acquisition Potential: Big pharma interest could arise from the drug’s novel mechanism and unmet need.

- Valuation Re-Rating: Current market cap is below peers, offering upside if trial success continues.

- Clinical Trial Risk: Phase 1b success does not guarantee Phase 2 approval—disappointing December data could lead to sharp declines [3][6].

- Financial Constraints: GANX’s unprofitable status (EPS -$0.61) and limited cash reserves ($15M as of Q3 2025) raise concerns about funding future trials [0][6].

- Volatility: The stock’s 7.53% 1-day move and high volume indicate rapid price change potential [0].

- Competition: Rivals like Amicus Therapeutics and Sanofi are developing similar GCase-targeted therapies.

- Market Metrics: Price ($3.14), 1-day change (+7.53%), volume (1.93M, 2x avg), market cap ($113.34M) [0].

- Trial Progress: Phase 1b (21 patients enrolled) with positive efficacy signals [4][6].

- Upcoming Catalysts: December 2025 (biomarker data, extended trial results, IND submission) [1][2].

- Risk Factors: Clinical trial failure, financial constraints, volatility, competition.

This analysis provides objective context for decision-making without investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.